Reversal Setups

These patterns are formed after the market has had an extended move up or down and the price reaches a strong resistance or support respectively.

When price reaches such a point it starts to form a pattern. Since these formations are frequently formed it is easy to spot them once you learn how and start using them. There are four types:

- Double Tops

- Double Bottoms

- Head and shoulders

- Reverse Head & shoulders

This learn tutorial will only cover double tops and bottoms, for the other 2, read this other tutorial: head & shoulders and reverse head & shoulders

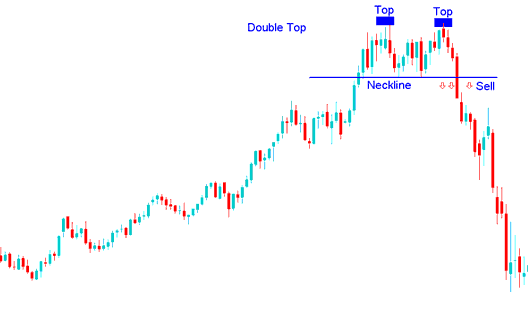

Double Tops

This is a reversal stocks pattern that forms after an extended upwards trend. As its name implies, this pattern is made up of 2 consecutive peaks which are roughly equal, with a moderate trough between.

This formation is considered complete once price makes second peak and then penetrates lowest point between the highs, known as the neck-line. The sell signal from the formation forms when the market breaks-out below neck-line.

In Stocks, this formation is used as a early warning signal that a bullish trend is about to reverse. However, it's only confirmed once the neck-line is broken & the market moves below the neck-line. Neckline is just another term for last support level formed on the chart.

Summary:

- Forms after an extended move upward

- This formation indicates that there will be a reversal in the market

- We sell when the price breaks out below neck-line: see below for explanation.

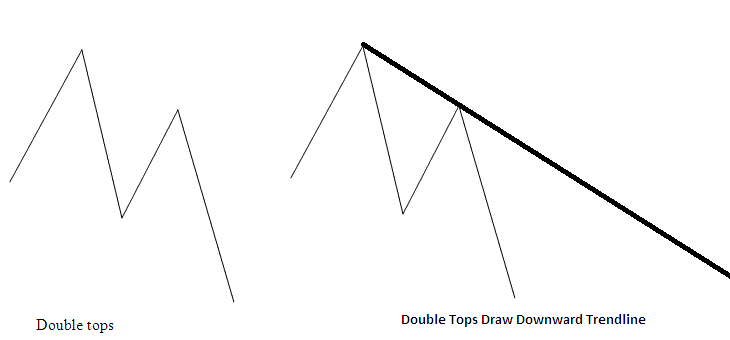

The double top look like an M Shape, the best reversal stocks signal is where the second top is lower than the first one as pictured below, this means that the reversal can be confirmed by drawing a down-wards trendline as shown below. If a trader opens a sell signal the stop loss will be placed just above this downwards trendline.

M Shaped

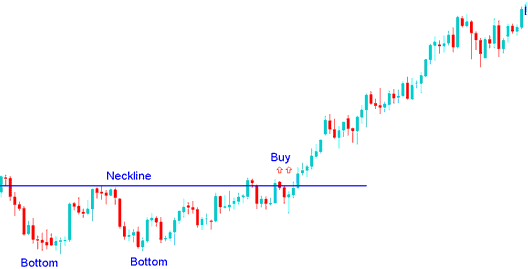

Double Bottom

This is a reversal stocks pattern that forms after an extended down-wards trend. It is made up of 2 consecutive troughs which are roughly equal, with a moderate peak between.

This formation is considered complete once price makes second low and then penetrates highest point between the lows, known as the neck-line. The buy indication from the bottoming out signal forms when the market breaks-out the neck-line to the upside.

In Stocks, this formation is an early warning signal that the bearish trend is about to reverse. It is only considered complete/confirmed once the neckline is broken. In this formation the neck-line is the resistance level for the price. Once this resistance is broken the market will move up.

Summary:

- Forms after an extended move downwards

- This formation indicates that there will be a reversal in the market

- We buy when price breaks out above the neck line: see below for the explanation.

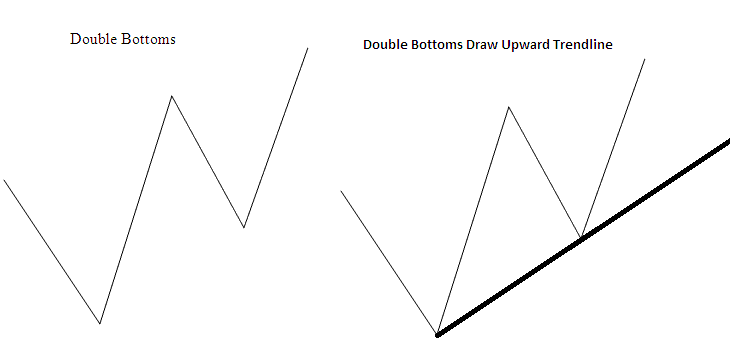

The double bottoms pattern look like a W Shape, the best reversal stocks signal is where the second bottoms is higher than the first one as displayed below, this means that the reversal can be confirmed by drawing an upward trendline as shown below. If a trader opens a buy signal the stop loss will be placed just below this up-ward trendline.

W Shaped