Reversal Chart Patterns: Head & Shoulders & Reverse Head Shoulders

Head & shoulders Chart Setup

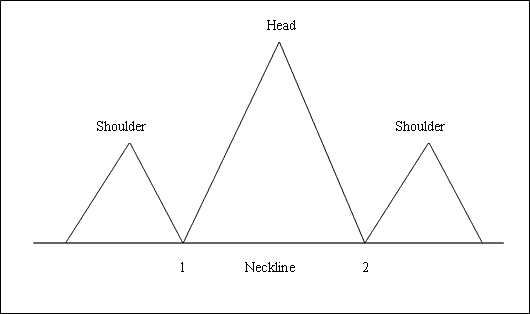

This is a reversal pattern that forms after an extended Stocks Trading upwards trend. It is made up of 3 consecutive peaks, the left shoulder, the head & the right shoulder with 2 moderate troughs between the shoulders.

This pattern is considered complete once trading price penetrates and moves below neck line, which is plotted by connecting these 2 troughs in between the shoulders.

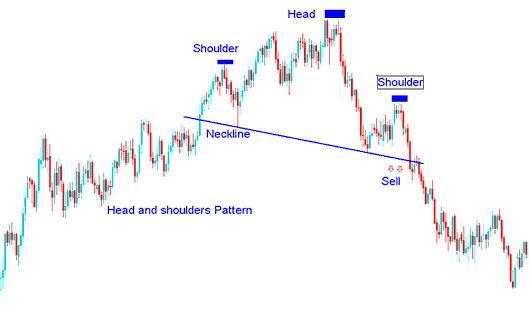

To go short, traders place their sell stop pending orders just below the neckline.

Summary:

- This Stocks Trading pattern forms after an extended move upwards

- This formation indicates that there will be a reversal in the market

- This formation resembles head with shoulders thus its name.

- To draw the neckline we use chart point 1 & point 2 as displayed below. We also extend this line in both directions.

- We sell when the price breaks below the neck line: see the chart below for explanation.

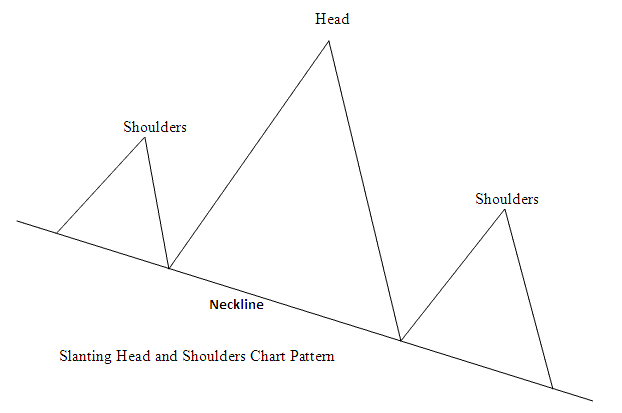

Or the head & shoulders can also form on a slanting neck line, like the example illustrated & described below:

Examples of Head & Shoulders Pattern on a Chart

Head & Shoulders Pattern

This pattern can also be formed on a slanting neck line, like the one above, the neck line doesn't have to be necessarily horizontal.

Reverse Head & Shoulders Trading Setup

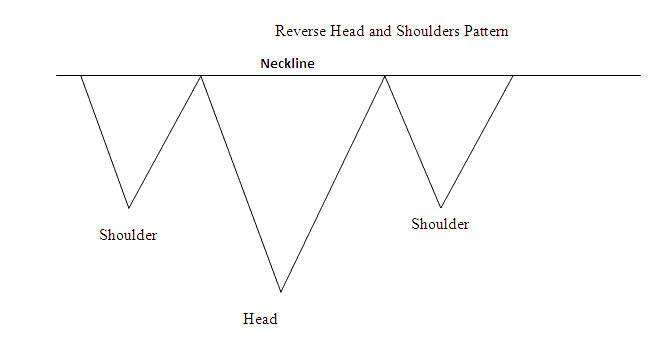

This is a reversal head and shoulders pattern that forms after an extended Stocks Trading downwards trend. It resembles an upside-down head shoulders.

This pattern is considered complete once price penetrates above the neck-line, which is plotted by connecting these two peaks between the reverse shoulders pattern.

To go long buyers place their buy stop pending orders just above the neck-line.

Summary:

- This Stocks Trading pattern forms after an extended move downwards

- This formation indicates that there will be a reversal in the market

- This formation resembles upside down, thus the name Reverse.

- We buy when price breaks above the neck line: see the chart below for explanation.

Examples of Reverse Head & Shoulders Pattern on a Chart

Examples of Reverse Head & Shoulders Pattern