MACD Stock Indices Classic Bullish & Bearish Divergence

The regular MACD divergence setup can be a signal that a trend might change direction. MACD classic divergence is used to find spots where the price might turn around and head the other way. Because of this, the MACD classic divergence setup is a way to enter with less risk and to know when to exit a trade.

A low-risk strategy involves opening sell positions near market tops or buying close to market bottoms, reducing risk compared to potential rewards.

2. It is used to predict the ideal optimum point/level at which to exit a trade

There are two types of Stock Index Classic Divergence:

- Classic Bullish Divergence

- Classic Bearish Divergence Setup

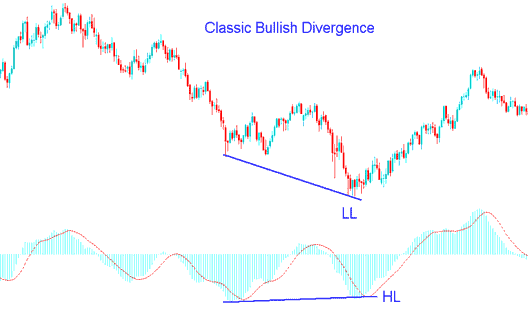

Classic Bullish Divergence in Indices Trade

A typical bullish divergence in Index happens when prices make new lower points, but the oscillator indicator makes higher low points.

MACD Classic Bullish Divergence - MACD Divergence System

A classic bullish divergence in indices signals a trend shift from down to up. Prices dip lower, but seller volume drops, as MACD shows. This points to cracks in the downtrend.

Classic bearish divergence in Index Trade

Classic bearish divergence in Index occurs when the price is making a higher high (HH), but the oscillator is lower high (LH).

Identifying MACD Classic Bearish Divergence in Index Trading – Utilizing the MACD Divergence System.

A classic bearish divergence may indicate a potential market trend reversal from an upward movement to a downward one. This occurs when prices rise but buyer volume diminishes, as highlighted by indicators like MACD - signaling a weakening upward trend.

Learn More Lessons & Topics:

- Calculating Margin for XAUUSD Trading with 1:50 Leverage

- How Can I Use MT5 Parabolic SAR in MT5 Platform?

- Bollinger Band: Fib Ratios Trading Indicator Analysis

- USD/CHF Market Open and Close Times Overview

- Learn how to trade XAU/USD online with this lesson guide.

- Balance of Power (BOP) Indicator Usage in MT4

- How Do I Trade Charts?

- Explanation of Forex Trade Swap Example

- How to Use Buy & Sell Indicator Signals

- What is the Way to Use the MT5 Gann Swing Oscillator?