Leverage & Margin in Stock Indices Trade

Leverage drives the rise of online trading. In old markets, index traders use just their own funds. Online, traders borrow from brokers. They mix this loan with their cash for larger trade sizes.

For illustration if a trader has $10,000 dollars in capital in the online market a trader can also borrow extra money when opening trade positions and open trade transaction of larger value than his $10,000 capital using trade leverage.

Traders can use a 100:1 ratio, the standard in online markets. This setup lets you control $100 for each $1 in your account. To find the full amount you handle, multiply your funds by 100. Say you put in $10,000. That turns into $1,000,000 for trading stock indexes. This borrowing option draws many to online index trading.

Traders often use borrowed funds for trading. Like any loan, you need collateral to secure it. What serves as security for this leveraged borrowing?

The security for this leveraged amount is the capital which you register an account with - in this case $10,000. This $10,000 is known as margin - margin is the security for the leverage that you'll be using. Therefore, in order and so as to continue accessing the leverage or borrowed capital you must make sure that you do not lose your capital so as to maintain this leveraged amount.

That's why, as a trader, you need to learn all you can about trading indices so you can keep making money in the market. This way, your account balance keeps growing, and you can keep using borrowed money.

How Do You Properly Trade with Leverage & Margin?

As a trader you need to know that just because you have been given 100:1 leverage you don't have to use all of it. If you want to trade in this market for long a long time you need to keep your used leverage to below 10:1. That way you do not blow your account in just a few trades, if you want to follow even better money management you can even minimize your used leverage to a maximum of 5:1 - especially if your capital is $20,000 or $50,000 or $100,000. The more capital you have the less leverage you need to use so as to better manage your capital so that as you trade longer.

The Difference between Maximum Leverage & Used Leverage

When your broker gives you 100:1 leverage, it's the highest available for your account. But you don't need to use it all: using about 10:1 or 5:1 is enough. This 10:1 or 5:1 leverage you use is called Used Leverage.

Money Management & the Best Leverage to Use

Stick to leverage under 10:1 for better control. Low leverage keeps free margin high. It beats your used margin easily.

If you make sure your leverage stays below 10:1, you should have enough free margin and can follow good rules for managing your money well.

If you use a lot of leverage you'll be over-leveraging & you'll not be following the best money management rules & you'll be taking greater risk with your invested capital.

To keep your overall risk at the lowest possible level, refrain from excessive leveraging, ensuring your utilized leverage remains below 10:1 or ideally below 5:1.

Example illustration of Leverage & Margin

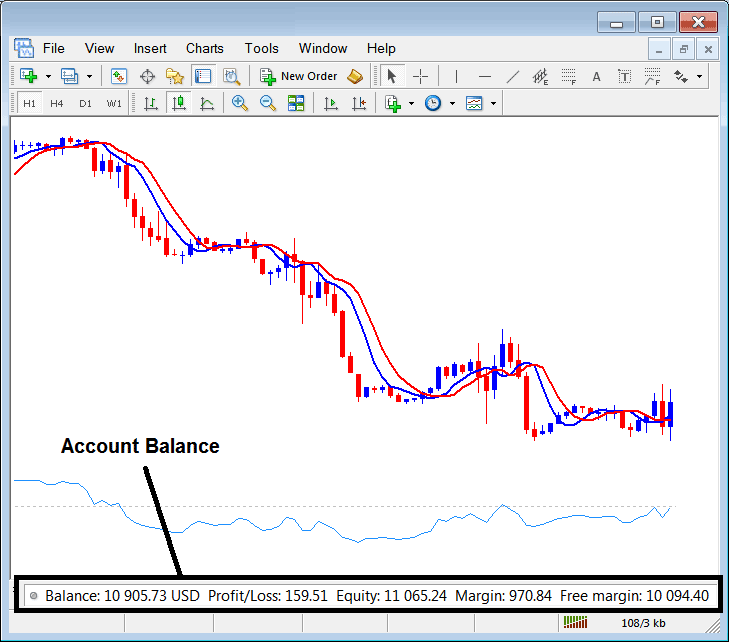

See an example of leverage and margin. Find both spots in the trading software.

Leverage & Margin Trading

On the above account the account balance is shown & displayed - $10,905

Profit is $159 dollars

The equity is $11,065

The Margin is $970 - This is the margin used for the trades that are currently open

Free Margin is $10,094

The margin utilized amounts to $970, reflecting approximately 8% of the equity, with total equity standing at $11,000. This indicates a leverage ratio of 8:1.

The free margin stands at $10,094, which is approximately ten times the utilized margin. This indicates prudent money management and appropriate leverage below 10:1 is being applied in this account.

As a trader, aim to keep trades near key levels to manage your account effectively and avoid excessive use of leverage, which could lead to over-leveraging.

This approach lets you earn solid profits without risking too much of your money.

How Leverage is Used in Stock Index Transactions?

If you take an example of three Indices in the online market that are shown:

1. Australia ASX200 - AUS 200Cash

Margin for one lot is AUD 70

With leverage applied, the necessary capital or margin required for a trader to initiate a position on the AUS 200Cash index is AUD 70: without any leverage applied, the index trader would be obligated to post AUD 7000 as trading capital.

2. Italy FTSEMIB40 - IT 40Cash

Margin per One Lot - € 250

The margin or required capital by a trader to open IT 40Cash index is € 250, this is after using leverage, if there was no leverage a stock index trader would be required to put up the € 25,000 as the capital.

3. Spain IBEX35 - SPAIN 35Cash

Margin per One Lot - € 140

The required collateral, or margin, for a trader initiating a trade on the SPAIN 35 Cash index is €140 subsequent to the application of leverage: without leverage, an indices trader would be obliged to commit €14,000 in trading capital.

From the above example you can see that leverage makes the online market available to most retail traders by reducing/decreasing the initial capital required by over 100 times using leverage ratio 100:1, this is the reason why stock indices trading is becoming popular.

Discover Extra Subjects & Educations: