IBEX35 Index

IBEX35 is an Stock Index which keeps track of the top 35 stocks in Bolsa Madrid - Spanish Stock Bourse. This Stock Index monitors capitalization of 35 most traded stocks in Madrid Stocks Market. The constituent stocks used to calculate this stock index are revised twice a year.

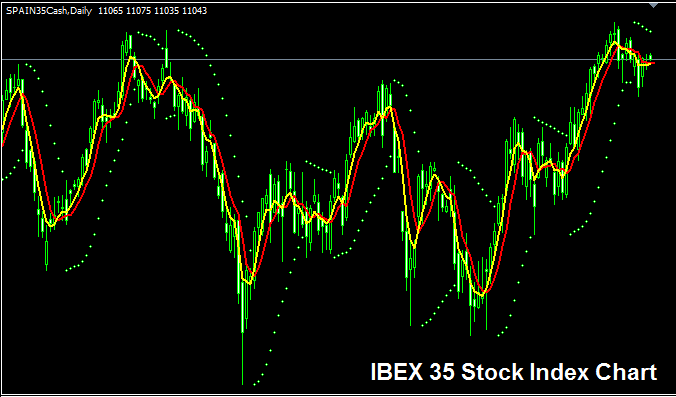

IBEX35 Chart

The IBEX35 chart appears above. In this example, the index is called SPAIN35CASH. Look for a broker that offers the IBEX 35 index chart so you can trade it. The example shown above is the IBEX35 index on the MT4 FX and index software platform.

Other Data about IBEX 35 Index

Official Index Symbol - IBEX:IND

The IBEX35 Index is composed of 35 highly successful corporations in Spain. These stocks collectively constitute most of the daily trading volume on the Madrid Stock Exchange.

-

The IBEX35 Index tracks the market capitalization of the top 35 companies in Spain. While this Index generally trends upward over the long term, it exhibits higher volatility in its movements compared to other indexes like the EURO STOXX and DAX 30, which tend to have more stable trends.

Over time, this index trends up. Stay positive and buy as it climbs higher.

A solid plan for this index is to buy dips and keep adding. But expect bigger swings and more ups and downs if you trade it.

During Economic Slow-Down and Recession

When the economy slows down or is in a recession, companies start to say they aren't making as much money and don't expect as much growth. Because of this, traders start selling shares of companies that say they're making less money, so Indices that track these stocks will also start to go down.

Therefore, during these specific periods, market momentum is highly inclined towards a downward trajectory, and you, as a trader, must adapt your trading methodology to align with the prevailing declining trends of the index you are actively trading.

Contracts and Details

Margin Requirement for 1 Lot - € 140

Value per Pips - € 1

Important: Even though the general trend usually goes upward, as a trader you have to think about and include how the market price changes every day: on some days, the Indices might stay in a range or even go back and forth, and the Index market pullback might sometimes be a big one, so as the trader you need to time your trade entry very carefully using this plan: Stock strategy and at the same time use the right money management rules and ideas just in case the market changes unexpectedly. About learning how to handle stock investments: What is managing stock investments and how to handle stock investments.

Study More Guides and Courses:

- How Can I Operate MT5 Ultimate Oscillator in MT5 System?

- Strategy for SPAIN35 Index

- Instructions for Interpreting/Analyzing Pips and Counting Pips Specifically for NZDJPY

- An introduction to XAU/USD trading online

- Gold MetaTrader 4 Software Download Tutorial

- How is SPAIN35 Index Traded in the MT4 & MetaTrader 5 Platform Software?

- Introduction to FX Guide for New Traders to Trade FX