Buy - Going Short in Stock Indices Trade

There are two trade positions that a trader can make when it comes to trading Index; a trader can either buy or a trader can either sell.

When a trader buys a Indices this is called going long

When a trader sells a Indices this is known as going short

Go Long

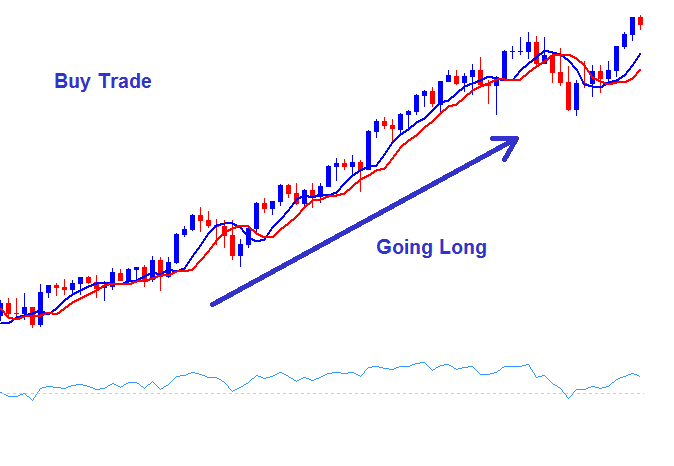

One will buy a Indices if they think it is going to go up based on their analysis. When a trader buys at a particular level the Indices must move up for the trader to make a profit. This buy trade also known & referred to as going long is illustrated below.

For this buy long trade the trader will continue making a profit as long as the Indices being traded keeps moving up such as shown above.

Go Short

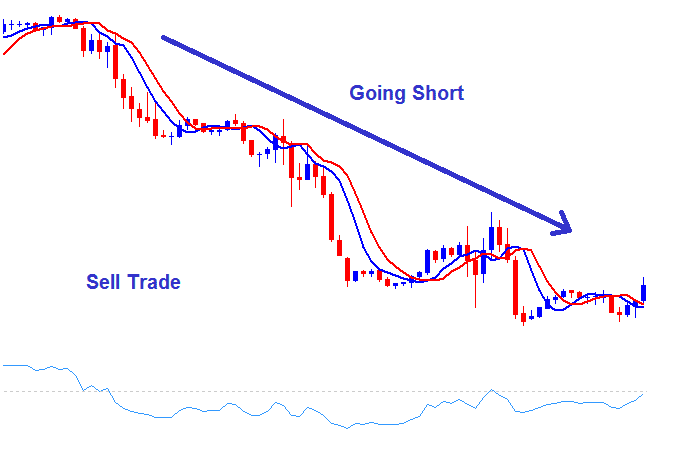

If a trader thinks that a particular Indices is going to move down, then trader will execute a sell position, the Stock Index trader will then make a profit as long as the Indices continues to move down just as is illustrated and shown below. This is known as going short.

For this trade the trader will continue to make a profit as long as this stock index continues moving downward.

As a trader you'll have to use technical analysis to analyze which direction the market is likely to move & then once you determine the most likely direction you will either open a buy trade or sell trade.

Study More Guides & Guides:

- Movements in Forex Currencies

- Stock Index Trading Strategies for JP225 Indices

- Strategies for NKY 225 Index

- HANG SENG 50 Trade Strategy Tutorials

- How Can I day trade Index Overbought & Over-sold Levels?

- How Can I Use Bulls Power in Forex Trade?

- FX Trade Plan for Beginner Traders

- Aroon Oscillator Illustrated and Shown

- Insert Cycle Lines, Chart Text Label in XAU USD Charts on MT4 Platform

- GBPNOK Currency Pair