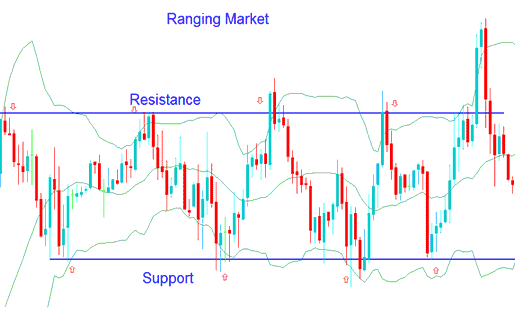

Bollinger Bands Price Action in Ranging Markets

The Bollinger Bands indicator helps identify moments when market trends might be overextended. The following guidelines are typically applied when using this tool in a sideways trend.

The Bollinger Bands indicator is highly significant as it often provides advance warning signals that a major price breakout event might be imminent.

These analytical methods lose their validity during periods dominated by trends: they are only reliable as long as the Bollinger Bands maintain a horizontal orientation.

- If the price touches the upper band it can be considered over-extended on the up-side - over-bought.

- If the market price touches/tests the lower band the currency can then be considered over-extended on the bottom side - oversold.

One way to use the Index Bollinger Bands tool is to follow the rules above for when something is too bought or sold to decide when to buy or sell in a stable market.

- If price has bounced off the lower band crossed the centerline MA then the upper band can be used a sell level.

- If the price bounces down off the upper band crosses below the center moving average(MA) the lower band can be used as a buy level.

Bollinger Bands on Ranging Markets - Bollinger Bands Strategy

When the price in the market above is going up and down within a range, hitting the top or bottom lines can show where to take profits on Index positions.

When the market reaches the top resistance level or bottom support level, trades may be opened. If the price movement breaks out of the range within these Bollinger bands, a stop loss order should be set a few pips above or below, depending on the trade transaction that was initiated.

Get More Lessons:

- Getting Acquainted with the MT4 Platform

- Coppock Curve MetaTrader 4 Technical Indicator on Trading Forex

- NZDCAD Market Opening and Closing Times

- Practical Application of the Kurtosis Indicator in Forex Trading

- Ways of Studying Short Term Moving Average Tool

- How Can I Use MT5 Balance of Power Indicator?

- How Can I Identify a Consolidation Trading Pattern in FX?

- Which Leverage Setting is Most Advantageous for $30 Gold Investments?

- What's the Pips Value for USDHUF FX Pair?

- What Leverage Should I Use to Trade 1 FX Mini Lot?