Bollinger Band Trading Analysis - Investigating the Bulge and Squeeze Patterns

Bollinger Bands adjust on their own. They expand or contract based on price swings in indices.

Standard deviation gauges price swings in indexes. It helps set the spread of Bollinger bands. Prices jump more when deviation rises. It drops when prices stay steady.

- When Indices price volatility is high the Bollinger Bands widen.

- When Indices price volatility is low the Bollinger Bands narrows.

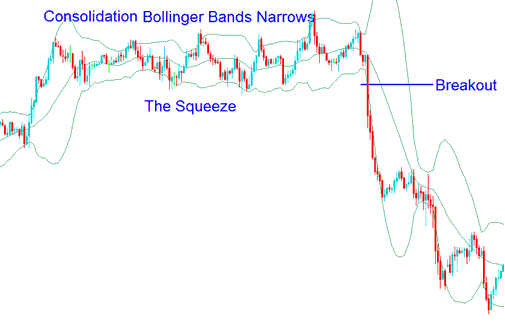

Trade the Bollinger Bands Squeeze

When the lines of the Indices Bollinger Bands contract, it signifies a period of price consolidation for the Indices, a phenomenon known as the Bollinger Band Squeeze.

When the Bollinger Bands indicator shows a narrow standard deviation, it usually means Indices prices are consolidating, signaling a potential Indices price breakout, and shows Index traders are changing their positions for a new move. Also, the longer the Indices prices stay within the narrow bands, the higher the chance of a breakout.

Bollinger Squeeze - How to Trade the Bollinger Bands Squeeze

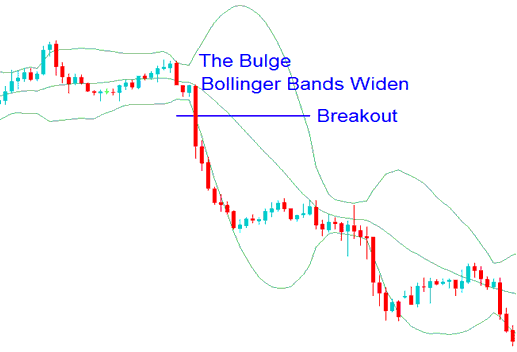

The Bollinger Expansion - Tips for Trading Bollinger Bands Expansion

The expansion of Bollinger Bands signals a breakout in Indices price movement and is known as the Bollinger Bands Bulge phenomenon.

When Bollinger Bands are spaced out widely, it can hint that a change in trend is coming. In the example of the Bollinger Bands below, the bands widen a lot because of high price fluctuations during a downward movement. The trend changes when prices hit an extreme level, according to statistics and the idea of normal distribution. The "bulge" indicates a switch to a downtrend.

Bollinger Expansion - Tips for Trading Bollinger Bands Expansion

More Lessons:

- S&P500 Strategies List & Best S&P Strategies for trading S&P

- Inquiry Regarding the Availability of Micro, Mini, and Standard Account Types for Gold Trading

- What's the Forex Pips Value for TRY JPY FX Pair?

- How to Set the EUROSTOXX 50 Index on MetaTrader 5

- FX EUR DKK Pip Calculator

- Technical Analysis of the Triple Exponential Average (TRIX) Indicator within MetaTrader 4

- How Can I Open Real Forex Account for MT4 Platform?

- Analyzing MACD Signal: The Crossover Between the Fast Line and the Center Line