What is Linear Regression Slope Indicator?

Linear Regression Slope - Linear Regression Slope indicators is a popular indicator that can be found on the - Indicators Listing on this website. Linear Regression Slope is used by the traders to forecast price movement depending on the chart price analysis done using this Linear Regression Slope indicator. Traders can use the Linear Regression Slope buy and Sell Signals explained below to determine when to open a buy or sell trade when using this Linear Regression Slope indicator. By using Linear Regression Slope and other indicators combinations traders can learn how to make decisions about market entry and market exit.

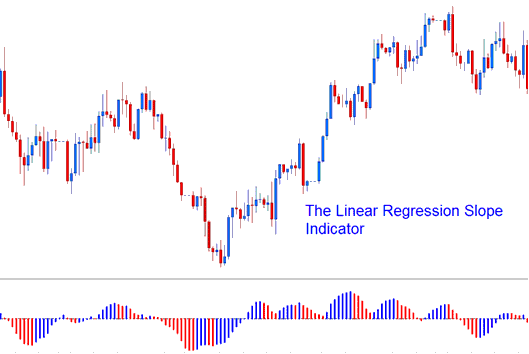

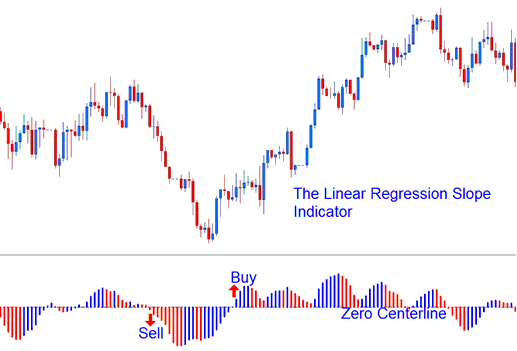

What is Linear Regression Slope Indicator? Linear Regression Slope Indicator

How Do You Combine Indicators with Linear Regression Slope ?

Which Indicator is the Best to Combine with Linear Regression Slope?

Which is the best Linear Regression Slope combination for forex trading?

The most popular indicators combined with Linear Regression Slope are:

- Relative Strength Index

- MAs Moving Averages Indicator

- MACD

- Bollinger Bands Indicator

- Stochastic

- Ichimoku Indicator

- Parabolic SAR

Which is the best Linear Regression Slope combination for Forex trading? - Linear Regression Slope MT4 indicators

What Indicators to Combine with Linear Regression Slope?

Get additional indicators in addition to Linear Regression Slope that will determine the trend of the market price and also others that confirm the market trend. By combining indicators that determine trend & others that confirm the trend and combining these indicators with Forex Linear Regression Slope a trader will come up with a Linear Regression Slope based system that they can test using a demo account on the MetaTrader 4 platform.

This Linear Regression Slope based system will also help traders to determine when there is a market reversal based on the technical indicators signals generated & hence trade positions can know when to exit the market if they have open trades.

What is Linear Regression Slope Based Trading? Indicator based system to interpret and analyze price & provide signals.

What is the Best Linear Regression Slope Forex Strategy?

How to Choose & Select the Best Linear Regression Slope Forex Strategy

For traders researching on What is the best Linear Regression Slope forex strategy - the following learn forex tutorials will help traders on the steps required to guide them with coming up with the best strategy for market based on the Linear Regression Slope system.

How to Create Linear Regression Slope Forex Systems Strategies

- What is Linear Regression Slope Strategy

- Developing Linear Regression Slope Forex Strategy Template

- Writing Linear Regression Slope Forex Strategy Trade Rules

- Generating Linear Regression Slope Forex Buy and Linear Regression Slope Sell Signals

- Developing Linear Regression Slope System Tips

About Linear Regression Slope Example Explained

Linear Regression Slope Analysis Trading Signals

Linear Regression Slope calculates the slope/gradient value of regression lines which involves the current price bar & the previous n-1 price bar (where n = regression periods)

This Indicator calculates this value & updates it for each price candle loaded in the price chart.

The Indicator is calculated from the Linear Regression Trading Indicator. The linear regression plots the market trend of the market price price chart over a specified and given duration of time & this trend is determined by plotting/drawing a Linear Regression Trend-Line using the "least squares fit" method. The slope of this trend-line is then calculated and this forms the linear regression.

Linear Regression Slope

The slope values are then smoothed by multiplying the raw slope indicator values by 100 and then dividing this value by price

Linear Slope Regression = (raw value of the slope * 100 / price).

The smoothing of the slope values is essential when comparing markets that are volatile & trade within wide price ranges for each price candle. Smoothed slope value will show the percent change in the price per every candlestick used to calculate the regression (best fit) line.

Technical Analysis and How to Generate Trading Signals

- If the smoothing of the slope is 0.30, then the regression line is rising and adjusting at the rate of 0.30 % for every candlestick.

- If the smoothing out of the slope of -0.30, then the regression line is going down and adjusting at the rate of -0.30% for every candlestick.

The regression slope is displayed as a bi-color histogram that oscillates above and below zero centerline. Center-Line which is used to generate trade signals is set at 0 level mark.

- A rising slope (greater than the previous value of 1 candlestick ago) is displayed and shown in the Blue/Upwards Slope colour,

- A declining slope (lower than the previous value of 1 candlestick ago) is illustrated & displayed in the Red/Downwards Slope color.

Technical Analysis in FX Trading

More Topics and Tutorials: