What is Bollinger Bandwidth Indicator? - Definition of Bollinger Bandwidth Indicator

Bollinger Bandwidth - Bollinger Bandwidth indicators is a popular indicator which can be found in the - Indicators List on this site. Bollinger Bandwidth is used by the FX traders to forecast price movement based on the chart price analysis done using this Bollinger Bandwidth indicator. Traders can use the Bollinger Bandwidth buy & Sell Trading Signals explained below to figure out when to open a buy or sell trade when using this Bollinger Bandwidth indicator. By using Bollinger Bandwidth and other indicators combinations traders can learn how to make decisions about market entry and market exit.

What is Bollinger Bandwidth Indicator? Bollinger Bandwidth Trading Indicator

How Do You Combine Trading Indicators with Bollinger Bandwidth? - Adding Bollinger Bandwidth in MT4

Which Indicator is the Best to Combine with Bollinger Bandwidth?

Which is the best Bollinger Bandwidth Forex indicator combination for forex trading?

The most popular indicators combined with Bollinger Bandwidth are:

- Relative Strength Index

- MAs Moving Averages Indicator

- MACD

- Bollinger Bands Indicator

- Stochastic Oscillator Indicator

- Ichimoku Indicator

- Parabolic SAR

Which is the best Bollinger Bandwidth combination for Forex trading? - Bollinger Bandwidth MT4 indicators

What Indicators to Combine with Bollinger Bandwidth?

Get additional indicators in addition to Bollinger Bandwidth that will determine the trend of the price and also others that confirm the market trend. By combining forex indicators which determine trend and others that confirm the trend and combining these technical indicators with FX Bollinger Bandwidth a trader will come up with a Bollinger Bandwidth based system that they can test using a demo account on the MT4 platform.

This Bollinger Bandwidth based system will also help traders to figure out when there is a market reversal based on the technical indicators signals generated and thence trades can know when to exit the market if they have open trades.

What's Bollinger Bandwidth Based Trading? Indicator based system to analyze and interpret price and provide trade signals.

What's the Best Bollinger Bandwidth Trading Strategy?

How to Choose & Select the Best Bollinger Bandwidth Forex Strategy

For traders researching on What is the best Bollinger Bandwidth forex strategy - the following learn forex guides will help traders on the steps required to course them with coming up with the best strategy for forex market based on the Bollinger Bandwidth system.

How to Develop Bollinger Bandwidth Trading Strategies

- What's Bollinger Bandwidth System

- Creating Bollinger Bandwidth Trading System Template

- Writing Bollinger Bandwidth Trading System Rules

- Generating Bollinger Bandwidth Forex Buy & Bollinger Bandwidth Sell Trading Signals

- Creating Bollinger Bandwidth Trading System Tips

About Bollinger Bandwidth Described

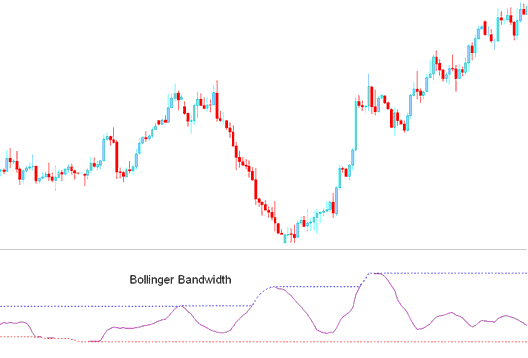

Bollinger Bandwidth Analysis and Bollinger Bands width Signals

Developed by John Bollinger.

This indicator is derived from the original and initial Bollinger indicator.

Bandwidth is a measure of width of Bollinger Bands.

Calculation

Band-width = Upper Band - Lower Band

Middle Band

This is an oscillator trading indicator, based on the theory that price & volatility occurs in cycles.

Periods of high price volatility is followed by the periods of low volatility.

When volatility is high, bands are far apart, the bandwidth also will be wide apart.

When volatility is low, Bands are narrow and the band-width trading indicator also will be narrow.

The blue line represents the highest Band-width value for a previous number of given periods.

This line also identifies periods of high price volatility

The red line represents the lowest Bandwidth value for a previous number of periods.

This line also identifies the periods of low volatility

FX Analysis and Generating Signals

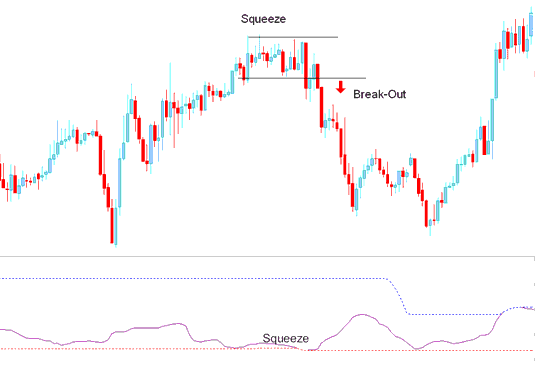

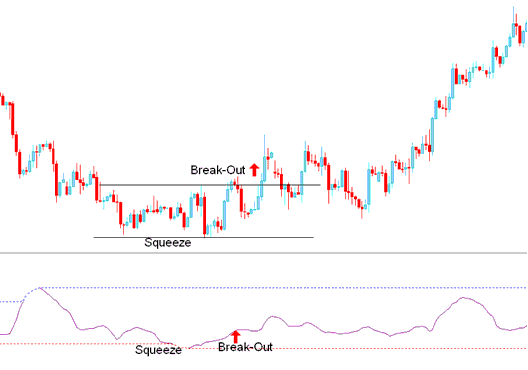

Consolidation - Bollinger Bands Squeeze

Bollinger Bandwidth is used to identify the squeeze, which is a consolidation period of price, after which the price then breaks out in a particular direction.

The Signals are generated/derived when there is a price breakout - signal gets derived & generated by indicator beginning to go up after touching the red line. When the bandwidth line starts and begins to move up it signifies that market volatility is rising as the price is breaking-out.

Squeeze

Breakout Signal After Band-width Squeeze

However, this is a directionless indicator and needs to be combined with another indicator such as the moving average to figure out the direction of the trend/ Breakout.

Get More Courses:

- How Can I Read Support Resistance Levels using Support Resistance Trading Indicator?

- Best Currency Pairs for Trend Following Traded in the Forex Market

- Technical Indicator MetaTrader 4 Hull Moving Average Indicator

- Learn XAUUSD Guide Website

- MetaTrader NIKKEI Indices NIKKEI225 MT4 Forex Software

- William Percent R Trading Buy Sell Trade Signal