What is ADX Indicator? - Definition of ADX Indicator

ADX - ADX indicators is a popular technical indicator which can be found on the - Indicators List on this site. ADX is used by the traders to forecast price movement based on the chart price analysis done using this ADX indicator. Traders can use the ADX buy and Sell Signals explained below to determine when to open a buy or sell trade when using this ADX indicator. By using ADX and other indicators combinations traders can learn how to make decisions about market entry and market exit.

What is ADX Indicator? ADX Indicator

How Do You Combine Indicators with ADX? - Adding ADX in the MT4 Software

Which Indicator is the Best to Combine with ADX?

Which is the best ADX combination for trading?

Most popular indicators combined with ADX are:

- RSI

- Moving Averages Indicator

- MACD

- Bollinger Band

- Stochastic

- Ichimoku Indicator

- Parabolic SAR

Which is the best ADX combination for trading? - ADX MT4 indicators

What Indicators to Combine with ADX?

Get additional indicators in addition to ADX that will determine the trend of the market price and also others that confirm the market trend. By combining indicators that determine trend and others that confirm the trend & combining these indicators with ADX a trader will come up with a ADX based system that they can test using a practice trading demo account on the MT4 software.

This ADX based system will also help traders to determine when there is a market reversal based on the technical indicators signals generated & hence trade positions can know when to exit the market if they have open trades.

What is ADX Based Trading? Indicator based system to interpret and analyze price and provide signals.

What is the Best ADX Strategy?

How to Select and Choose the Best ADX Strategy

For traders researching on What is the best ADX strategy - the following learn tutorials will help traders on the steps required to guide them with coming up with the best strategy for market based on the ADX system.

How to Create ADX Systems - Best Indicators Combination for ADX

- What's ADX Trading Indicator Strategy

- Developing ADX Strategy Template

- Writing ADX Strategy Trade Rules

- Generating ADX Buy and ADX Sell Signals

- Creating ADX System Tips

About ADX Example Explained

ADX Technical Analysis & ADX Signals

Created and Developed by J. Welles Wilder

This a momentum indicator used to determine the strength of a market trend: it is derived from the DMI - Direction Movement Index which has two lines.

+DI - Positive Direction Movement Index

–DI - Negative Direction Movement Index

ADX is calculated by subtracting these 2 values and applying a smoothing function.

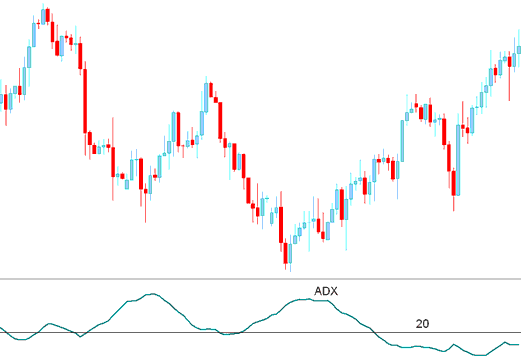

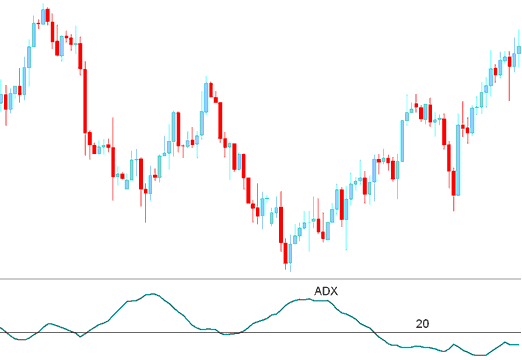

The ADX isn't a directional indicator but a measure of the momentum of the market trend which has a scale of Zero to 100.

Higher the indicator value the stronger the price trend.

A value of below 20 reflects the market is not trending but moving in a range.

A value of above 20 confirms a buy or sell signal and indicates a new trend is emerging.

Values above 30 indicates a strong trending market.

When ADX trading indicator turns down from above 30, it signifies that current market trend is losing force.

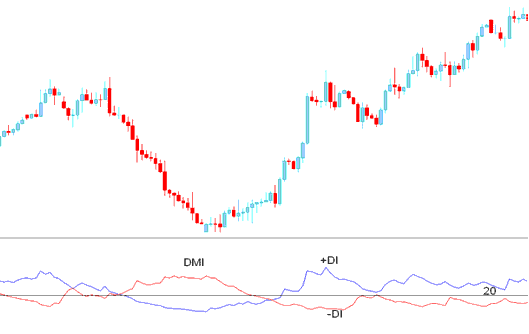

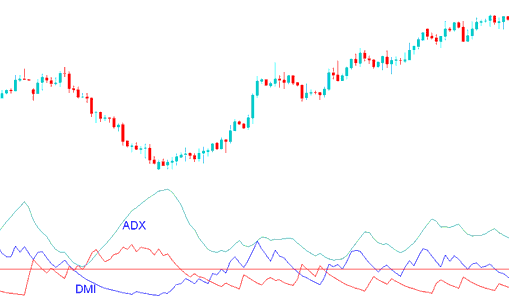

ADX combined with DMI - Direction Movement Index Indicator

Since ADX alone is a directionless indicator it's combined with the DMI index to figure-out the direction of the currency pair.

DMI

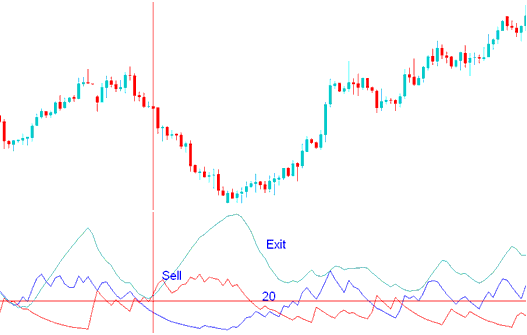

ADX and DMI Index

When the ADX is combined with DMI index a trader can figure out the direction of the market price trend and then use the this indicator to determine the energy of the current trend direction.

Technical Analysis & Generating Signals

Buy Trading Signal

A buy trade signal is generated/derived when the +DI is above –DI, and the ADX trading indicator is above 20

Exit signal is derived and generated when trading indicator turns down from above 30.

Buy Trading Signal

Sell Signal

A short signal is generated/derived when the –DI is above +DI, & the ADX is above 20

The Exit signal is derived and generated when technical indicator turns down from above 30.

Sell Trade Signal

Learn More Tutorials & Guides:

- Buy Stop Order and Sell Stop Order

- How Can I Add S&P ASX in MetaTrader 5 S&P ASX App?

- Inserting Line Studies Tools on the MT4 Trading

- Parabolic SAR Settings Described

- XAG/USD Chart

- What's the Best XAUUSD Leverage for $200 in XAUUSD?

- How to Set US 100 on MT4 US 100 Mobile App

- How to Develop a EUR CHF System

- MACD MT4 Technical Indicator Forex Signals

- How Much Money Do You Need to Open a Trade Account?