Trade Setups Illustrating Classic Bullish and Classic Bearish Divergence using RSI

Traders in the foreign exchange market use the classic divergence pattern as a possible sign that a trend might change. The classic divergence trade setup is used when searching for a spot where the price of currencies might turn around and start moving in the opposite direction. Because of this, the classic divergence setup is used as a safe way to get into a trade and also as a precise way to get out of a trade.

- Classic divergence is a low risk method to open a sell near the top or buy near the bottom of a trend, this makes the risk on your trade transactions are small in relation to potential reward.

- Classic divergence setup is used to predict the optimum ideal point/level at which to exit a trade transaction

Two Kinds of Classic RSI Divergence Patterns Exist

- Classic Bullish Divergence Trading Setup

- Classic Bearish Divergence Trade Setup

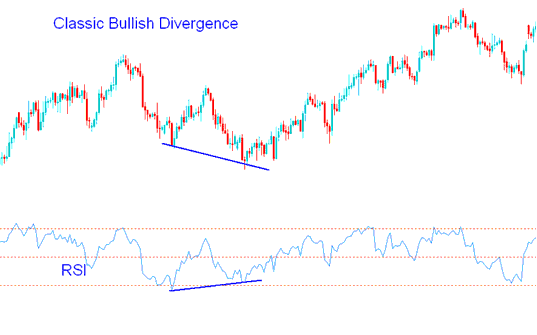

Classic Forex Bullish Divergence

A normal bullish difference in forex happens when the price is making lower lows (LL), but the oscillator tool is making higher lows (HL).

Classic Forex Bullish Divergence - RSI Strategies

Classic bullish forex divergence is a warning sign that the market might flip from a downtrend to an uptrend. Even if the price keeps dropping, if the selling volume drops too - like the RSI indicator shows - it usually means the downward trend is getting weak.

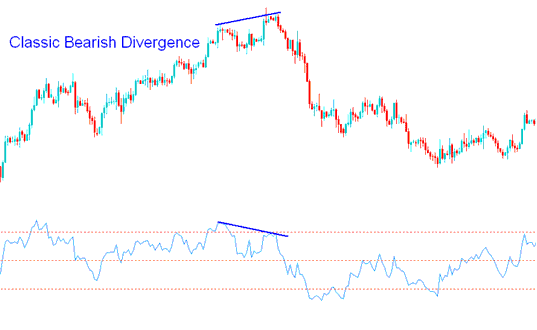

Classic Forex bearish divergence

Classic forex bearish divergence forms when price is making/forming a higher high (HH), but the oscillator technical indicator is lower high ( LH ).

Classic Bearish Divergence Trade with RSI Strategies

A classic bearish divergence in forex signals a potential shift in the trend from an upward movement to a downward one. This happens because, although the price may continue to climb, the buying momentum driving the price higher diminishes, as reflected by indicators like the RSI. This highlights an underlying weakness in the upward trend.

Discover More Subject Areas and Programs:

- How to Calculate AUD HKD Pip

- Strategies for Trading EUROSTOXX 50 Indices

- 1:100 Leverage Forex

- Tutorial for Trading HANGSENG 50 Indices

- Transforming Your Forex Psychology Mindset To Improve Your FX

- Analysis of Bullish and Bearish Divergence Patterns Observed using the RSI Indicator on Stock Indices

- Forex Four Decimal Points Currency Quotes Format

- What is the Implied XAU USD Leverage of 1:200 within XAU USD Trading?

- How to Add MT5 ATR Indicator on MetaTrader 5 Charts How to Set ATR Indicator MetaTrader 5 Charts

- Online XAUUSD Market Tutorial to Learn Trading