Guide to Adding the Stochastic Momentum Index (SMI) Indicator on MetaTrader 4 Charts

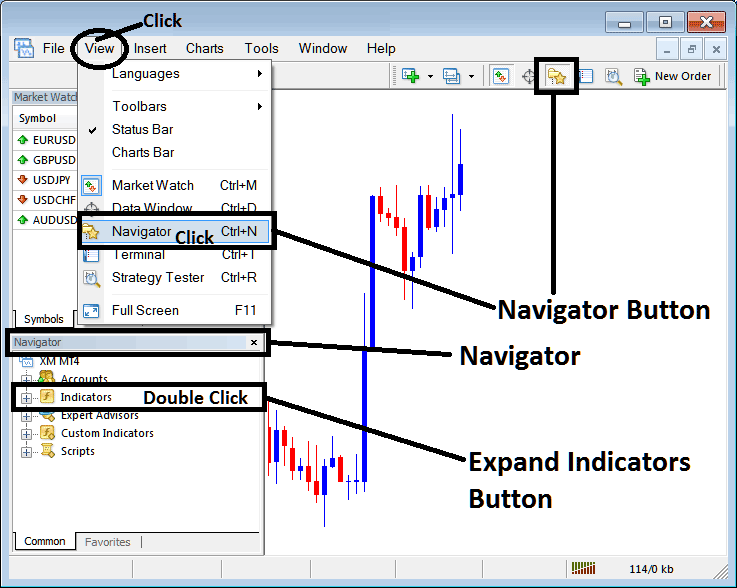

Step 1: Open Navigator Panel on Trading Software Platform

Open the Navigator window as shown and illustrated below: Go to the 'View' menu (press on it), then select 'Navigator' window (click), or From Standard ToolBar click the 'Navigator' button or press key board short-cut keys 'Ctrl+N'

On Navigator panel, choose 'Technical Indicators', (DoubleClick)

How to Set Up the Stochastic Momentum Index on MT4 - A guide to using this technical indicator on the MetaTrader 4 platform.

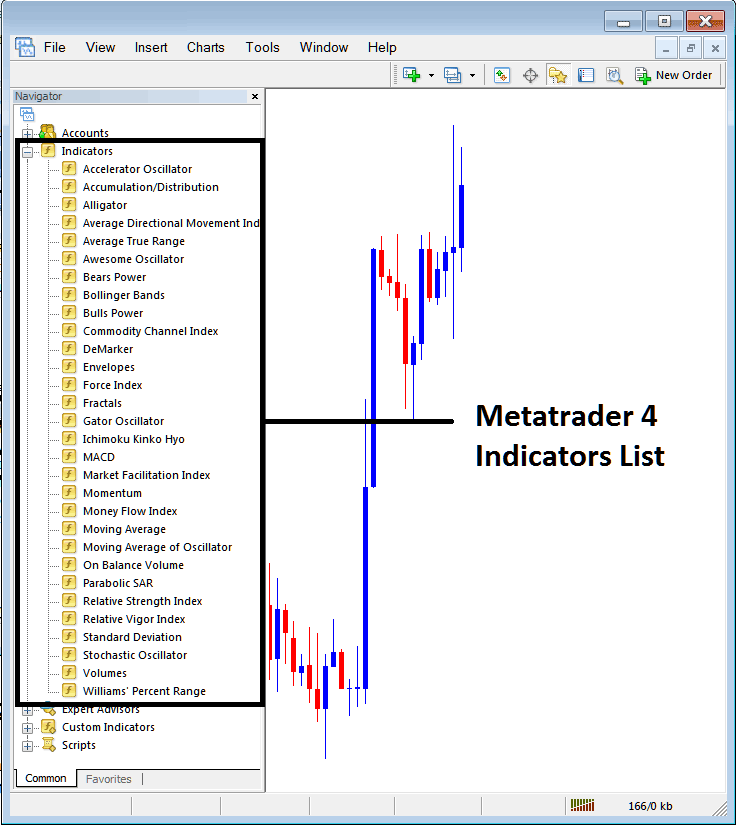

Step 2: Open Indicators Menu in Navigator - Add Stochastic Momentum Index to MT4

Expand the menu by clicking the unfold tool button impress mark ' + ' or double-click the 'indicators' menu, after that this button will appear and be shown as (-) & will now display a list just as shown below - choose the Stochastic Momentum Index technical indicator from this list of technical indicators so as to add the Stochastic Momentum Index to the chart.

How to Set Stochastic Momentum Index - In the window mentioned earlier, you can add the Stochastic Momentum Index you want to use on the Forex chart.

How to Set Custom Stochastic Momentum Index to MT4

If you want to add an indicator that isn't standard, like if you as a trader want to add the Stochastic Momentum Index and it's not standard, you first need to add this specific Stochastic Momentum Index on the MetaTrader 4 program and then put together the custom Stochastic Momentum Index, so the newly added Stochastic Momentum Index special technical indicator shows up on the list of special technical indicators on the MetaTrader 4 program.

Guidance on integrating Stochastic Momentum Index indicators into the MT4 Platform, how to incorporate the Stochastic Momentum Index window into MT4, and the procedure for adding the Stochastic Momentum Index custom indicator within the MT4 Software - detailed instructions on adding a custom Stochastic Momentum Index to MT4.

About Stochastic Momentum Index Tutorial Course PDF

SMI Technical Analysis Signals

Developed & Created by William Blau.

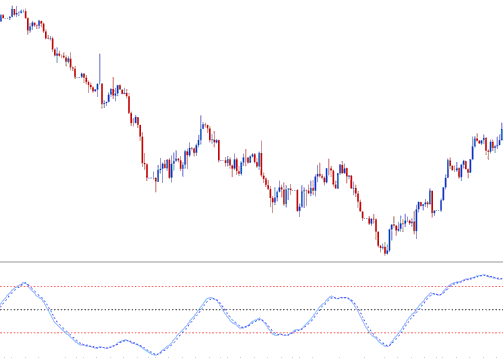

Stochastic Momentum Index, SMI is a version of the usual Stochastic Oscillator that makes the stochastics waves smoother.

Construction of Stochastic Momentum Index Indicator

This trading tool is figured out by looking at the price compared to the average/mean price over a certain amount of time.

Then, instead of using the values directly, they are smoothed with an Exponential Moving Average, and these smoothed values are used to create the SMI.

When the closing price is higher than the average/mean of the range, the SMI will go upwards.

Should the closing price fall beneath the range's average or mean, the SMI will exhibit a downward trajectory.

This particular oscillator fluctuates between +100 and -100 values: moreover, this technical analysis tool is generally less susceptible to false signals when contrasted and evaluated against the stochastic oscillator.

FX Analysis and How to Generate Trading Signals

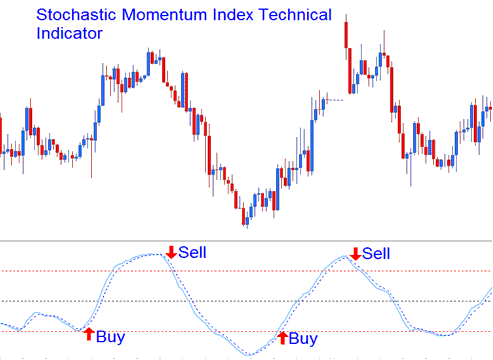

Buy and Sell Signals/ FX Crossover Signals

You can use the SMI to tell you when to buy and sell by using the method that is shown here, buy when the SMI goes up and sell when it goes down.

Buy and Sell Signals/ FX Crossover Signals

Overbought/Oversold Level Forex Cross overs

- Overbought levels above +40

- Oversold levels below -40

A buy signal occurs when this oscillator drops below the oversold threshold and subsequently rises above that level, starting to move upward.

Sell Signal is generated/derived when this oscillator rises above overbought level and then falls below this technical level & begins to move downward.

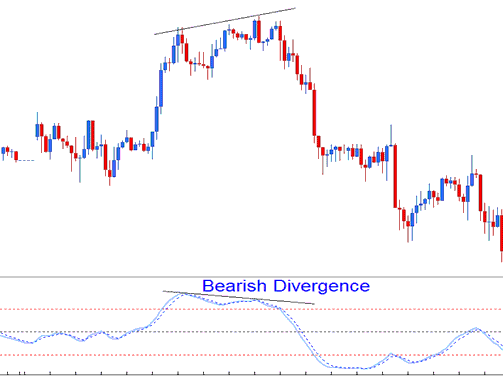

Divergence Forex Trading

The illustration below showcases a bearish divergence between price movement and Stochastic Momentum Index (SMI). When this divergence appeared, it signaled a trend reversal, with prices beginning to move downward.

Bearish Trade Divergence Setup

Study More Lessons and Tutorials & Courses:

- Can XAU USD be Traded Online?

- How to Set Fractals Trading Indicators to MetaTrader 4 Software Platform

- How Feelings Affect Gold in Trading

- Trading Systems for NKY225 Index

- Overview of Money Management Strategy Tools

- Criteria for Selecting the Optimal Linear Regression Acceleration Trading Strategy

- Best trading indicators for spotting divergence