How Do You Interpret Bull Pennant Pattern?

How Do You Trade Bull Pennant Setup?

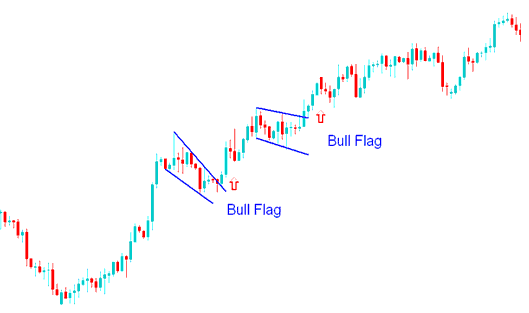

Bull pennant chart pattern forms what resembles a rectangle setup with a modest downwards tilt. The rectangle is formed by two parallel lines that act as support level and resistance zone for price til the price breaks out. In general, the bull pennant chart pattern will not be perfectly flat but it will be sloping and having a modest tilt.

The bull pennant setup is found within an upward trend. Bull pennant pattern is a continuation chart setup where the price retraces a little, bull pennant chart pattern is hence a modest price pull back with narrow price action which has got a slight downwards tilt. The buy signal gets derived/generated when price penetrates the upper line of the bull pennant chart pattern. The pennant portion of the bull pennant setup has price highs and price lows that can be connected by small lines that are parallel, and it resembles a small channel - pennant.

The bull pennant chart setup occurs at half-way point of a bullish upward trend & after a price break out a similar move equal to the height of the pennant pole is expected.

How Do You Interpret/Analyze Bull Pennant Pattern?

The bull pennant setup pictured above was just a consolidation phase as the market gathered momentum to breakout & move higher. The bull pennant pattern continuation signal was completed when the upper line of this Bull pennant chart pattern was broken to the up-side after which the price continued to move up-ward.

How Do I Analyze Bull Pennant Pattern?

Get More Topics and Courses:

- How to Use MetaTrader 4 Kase DevStop 2 Indicator

- Relative Strength Index RSI XAU/USD Indicators

- How Can I Add Nikkei on MT5 Nikkei App?

- Factors To Consider When Selecting Your Forex Broker

- What is USDTRY Spreads?

- Characteristics of the Three Major Forex Market Sessions: Asia, Europe and US Market Sessions