Dow Jones Industrial Average, also known as the Dow 30 - Wall Street 30 Index

The Dow Jones Industrial Average tracks 30 top US stocks. It uses the biggest companies in the country for its calculation.

The DJIA is the most well-known and watched stock index around the world. The Dow Jones Industrial Average used to track industrial stocks but now includes stocks from other parts of the economy. The stocks are chosen from the biggest American companies.

The DJIA is more volatile than most of the other Top Indices, The DJIA although will over the long term trend upwards it'll have more price pull back and more consolidations than other indices. Traders may & might prefer to trade other indices other than the Dow Jones Industrial Average if they are more used to trading the more stellar & robust trends found in other top indices.

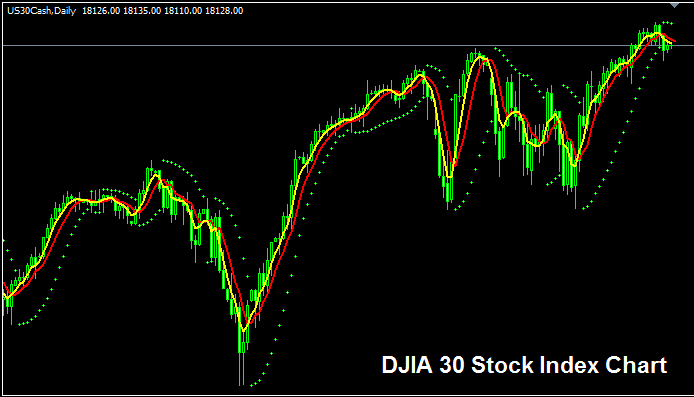

The DJIA 30 Index Chart

The DJIA 30 Index chart is displayed above. On the illustration put on display above this trading instrument is named as US30CASH . As a forex trader you want to search and find a broker that offers this The DJIA 30 Index chart so that you can begin to trade it. The example above is of DJIA 30 Index on the MetaTrader 4 FX & Stock Index Trading Platform .

Other Data about DJIA 30 Index

Official Symbol - DJI

The 30 stocks that make up the DJIA 30 Index are chosen from the best companies in America. However, how this index is figured out is different from other Indexes: the price of the 30 stocks is divided by a certain number to get the index. This makes this stock index change more quickly than others.

Strategy for Trading DJIA 30 Index

The method used to calculate the DJIA 30 Index results in greater volatility, leading to larger price fluctuations within this stock index. Despite this, over the long term, the index generally trends upward, reflecting the robust growth of the U. S. economy, which is also the world's largest.

As a currency trader considering trading this index, you should prepare for greater price fluctuations and increased volatility.

As an index trader, having a preference to continue buying as the stock index rises is advisable. When the US economy is thriving - which is often the case - an upward trend is likely to dominate. A prudent strategy would be to buy during price declines.

Contracts and Specifications

Margin Required Per 1 Lot/Contract - $ 150

Value per 1 Pip(Point) - $ 0.5

Note: Overall, the trend rises in a broad sense. Forex traders must account for daily price moves. Shares might swing or dip on some days. Dips can turn big at times. As a currency trader, nail entry timing with the Indices strategy. Use fitting money management tips for surprise trend swings. Topics on money rules: What money management is and its techniques.

More Tutorials: