Divergence in Forex Setups - Bullish and Bearish Divergence Trading

Divergence in FX is one of the trade transaction patterns used by the traders. It involves looking at a chart & one more indicator. For our example we shall use MACD indicator.

To spot this divergence trading setup find 2 chart points at which price makes and forms a new swing high or a new swing low but MACD doesn't, indicating a Divergence in Forex between price and momentum.

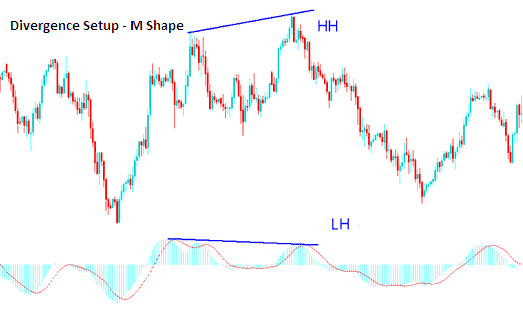

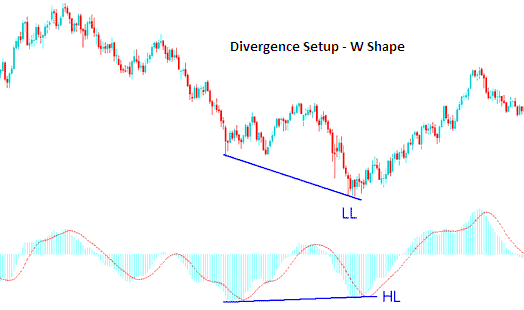

To look for Divergence in Forex we look for 2 chart points, 2 highs that form an M shape on the chart or 2 lows that form a W Shape on the trading chart. Then look for same M-shape or W-Shape on indicator you use to trade.

Explanation of a Divergence in Trade Setup:

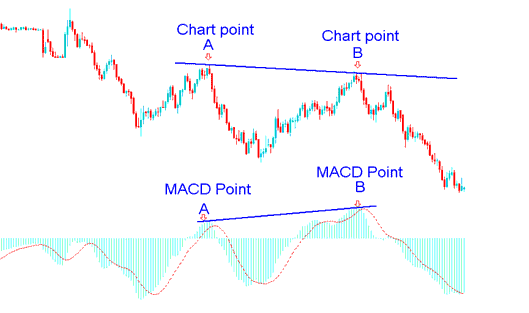

In the EURUSD chart below we spot two chart points, point A & point B (swing highs). These 2 points form an M-Shape on the price chart.

Then using MACD we check highs made by MACD, these are highs which are directly below Chart points A & B.

We then plot one line on the chart & another line on the MACD.

Drawing Divergence in Forex Lines

The chart above portrays example of one of the 4 types of Divergence in Forex, the one above is referred to as hidden bearish Divergence in Forex, one of best type to trade. Types of Divergence in Forex are discussed in the next tutorial.

How to spot Divergence in Forex

In order to identify divergence trade setup we look for the following:

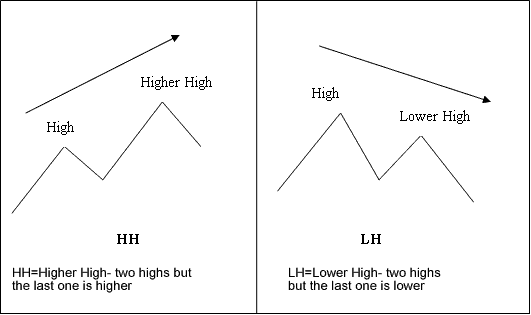

- HH = Higher High - 2 highs but the last is higher

- LH = Lower High - 2 highs but last one is lower

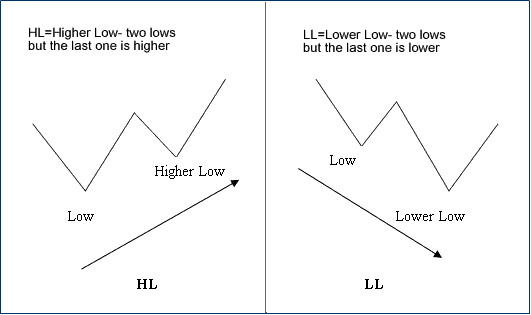

- HL=Higher Low : two lows but the last is higher

- LL = Lower Low - two lows but the last is lower

First let us look at the illustrations of these trading terms:

M-shapes dealing with Trading price Highs

Divergence in FX

W Shapes dealing with price lows

Divergence in Forex

Explanation of M-Shapes

Divergence in FX

Examples of W-Shapes

Divergence in Forex

Now that you have learned the Divergence in Forex terms that are used to explain trading set-up. Let us look at the 2 types of Divergence in Forex and how to trade these chart patterns.

There two types are:

- Classic Divergence in Forex

- Hidden Divergence in Forex

These 2 setups are expounded on following lessons below

Get More Topics and Tutorials:

- Stock Index Trade Analysis

- What is USDCAD Spread?

- What is USDPLN Spreads?

- Forex DeMarks Projected Range EA(Expert Advisor) Setup

- Nikkei225 Trading Strategies Guide Lesson Download

- FX Index Trade HangSeng in Trading

- What is Margin Requirement for 1 Lot of SWI20 Index?

- Top 100 Index Brokers Comparison

- MetaTrader Forex Signals with Automatic Trade Signal Copy Execution from MQL5

- Forex Accumulation/Distribution Expert Advisor Automated Trading Setup