What Does a Double Bottoms Chart Pattern Mean?

Double bottom xauusd setup is a reversal pattern that is formed after an extended downwards trend.

Double bottom chart pattern is made up of 2 consecutive troughs which are roughly equal, with a moderate peak between the two troughs.

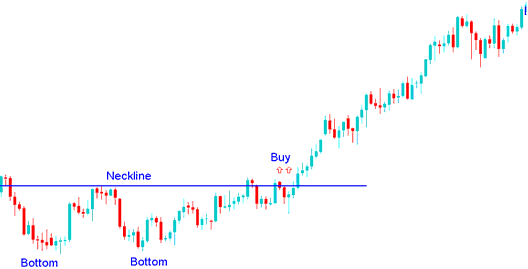

The buy signal from this double bottoms chart pattern market bottoming out signal occurs when the market breaks-out the neckline to the upside.

In XAUUSD, the double bottoms chart pattern is an early warning signal that the bearish trend is ready to reverse.

Double Bottom Pattern is only considered complete/confirmed once the neck-line is broken.

In this double bottoms chart patterns formation the neckline is the resistance level for the price. Once this resistance level is breached the market will move up.

Summary:

- Double bottom chart pattern forms after an extended move downward - gold downwards trend

- This Double bottom chart pattern formation indicates that there will be a reversal in market

- We buy when price breaks-out above neck line: as described on the example displayed and shown below.

What Does a Double Bottoms Pattern Mean?

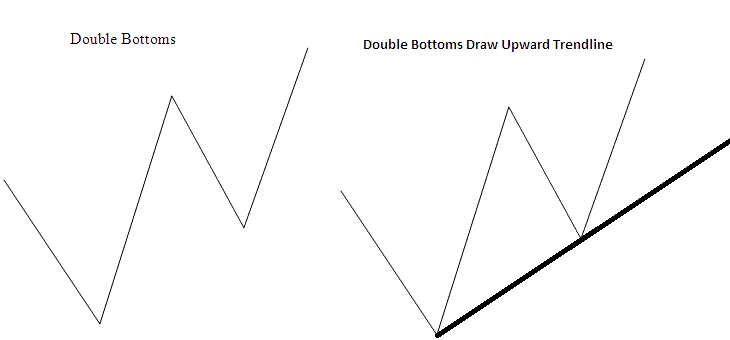

The double bottom pattern look like a W Shape chart pattern, the best reversal xauusd signal is where second bottom is higher than the first bottom as illustrated & displayed below.

This means that the reversal gold signal from the double bottoms pattern can be confirmed by drawing an upward trend-line as illustrated below. If a trader opens a buy signal the stop loss will be placed just below this upwards trend line.

What Does a Double Bottom Chart Pattern Mean? - What Happens to Price Action After a Double Bottoms Chart Pattern in XAUUSD