How to Use Support & Resistance to Trade XAUUSD

In the last lesson's trade examples, support and resistance zones held firm. They didn't break because they were solid.

At times, support and resistance levels may not be robust enough to deter a price's movement in a specific direction. When the price surpasses these levels, it is said that these technical points have been breached. Consequently, traders often employ stop-loss orders as a precaution if these levels fail to hold.

But what transposition occurs when these established levels are breached? The levels dynamically shift from one designation to another: for instance:

- When a support level is broken it becomes a resistance

- When a resistance level is broken it becomes a support

Charts Show What Happens When Key Levels Break

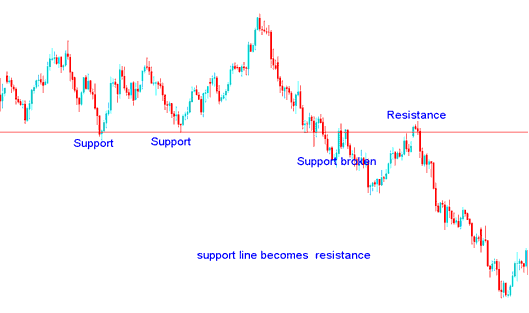

Support is broken it becomes a resistance

In the example here, the support level that was tested twice couldn't hold a third time, so sellers pushed the price lower.

Nevertheless, the price experienced an upward rebound, but this time it failed to surpass the established line. Subsequently, sellers (bears) exerted downward pressure, quickly pushing the price lower. This occurred because the line that previously functioned as support had converted into resistance.

In xauusd trading when a support is taken out, the stop loss orders placed below that point are also taken out, thus reducing the energy that the buyers(bulls) had. This give sellers an opportunity to short sell the gold & place their stops just above this level which now turns into a resistance level.

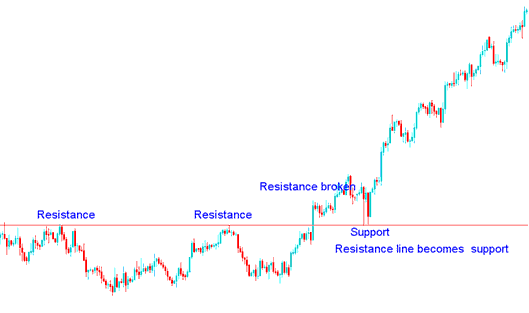

Resistance level is broken it becomes a support

In the example using the chart below, the resistance level tested twice could not hold the third time: buyers pushed prices past that level.

During subsequent attempts for prices to decline, this technical threshold hindered any further drop. Buyers quickly drove the price up from that level. This happened because the previous resistance level had shifted to become a support area. Such changes are common in XAUUSD: once a resistance level is surpassed, it often turns into a support zone.

Traders who had previously closed their bearish positions will now initiate bullish trade positions, placing their protective stop losses just beneath this identified technical boundary.

Major and Minor Resistance Areas

In XAUUSD charts, support and resistance zones are either strong levels or minor ones.

Major Resistance/Support levels

At important areas of Resistance/Support, prices will stay at this level for a while, and the price will either stay steady or form a rectangle shape when the price gets to this point. This price will be tested many times before it breaks through or stays put, stopping the price from moving past this area.

The above exemplifications are good examples of major Resistance & Support Areas.

Minor Resistance/Support levels

In small areas of resistance and support, the price will quickly create these points in a short time and then quickly go past them and the areas of support.

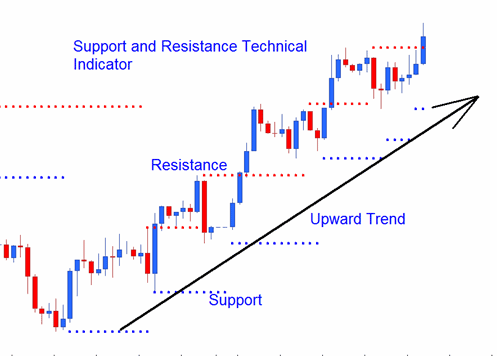

Upward Trend: Minor support and resistance spots create a rising line of levels.

Upward Trend Series of Support and Resistance

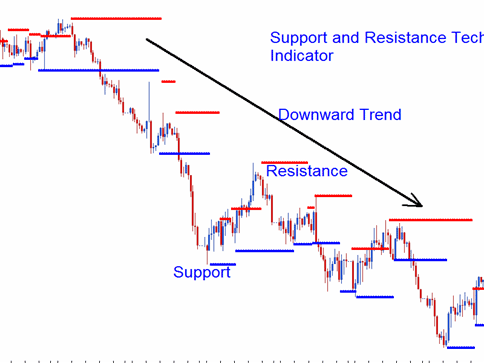

Downwards Trend: The way these smaller areas of resistance and support are arranged will create a series of zones that generally point downward.

Downward Trend Series of Support & Resistance

Examine More Subjects & Educations:

- Triple Exponential Average TRIX MT5 Trading Tool

- XAU/USD Training Course for Opening & Sign Up XAU USD Account

- Predefined Templates for XAUUSD Charts Found in the MT4 Platform Menu

- How to Create a CAD CHF System

- Website for New XAU/USD Trader Wanting to Start XAU USD Online

- SX 50 Indices Trading Strategy List & Best SX 50 Indices Trading Strategy to Trade SX 50

- Where is IBEX in MT4 Platform Software?

- Analysis of the Ichimoku Gold Indicator on Gold Charts