Trading Short-Term and Long Term Price Period of MA

A trader has the option to modify the price periods utilized for calculating the moving average (MA).

Using shorter periods for the Moving Average will result in the MA reacting more swiftly to fluctuations in market price.

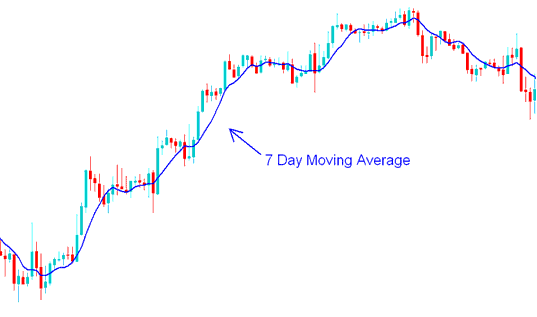

As an illustration, if a gold trader utilizes a Moving Average (MA) calculated over 7 days, this indicator will respond to price shifts far more rapidly than an MA derived from 14 or 21 days. Conversely, employing shorter timeframes for MA calculation can introduce volatility, potentially causing this technical indicator to generate erroneous signals (frequently referred to as whipsaws).

7 Day Moving Average(MA) - Moving Average(MA) Strategies Methods

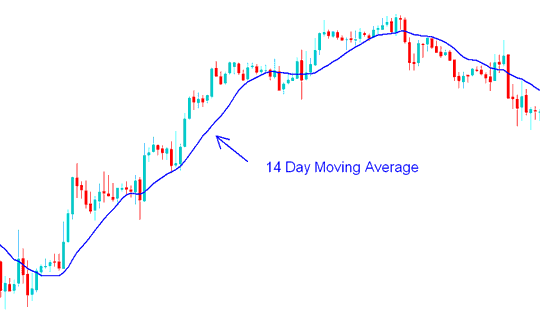

If a different trader opts for extended chart timeframes, the Moving Average will exhibit a much slower response to price shifts.

For example, if a trader uses the 14 day Moving Average indicator, the average won't change as fast, but it will react much more slowly.

14 Day Moving Average - Moving Average Strategy Example

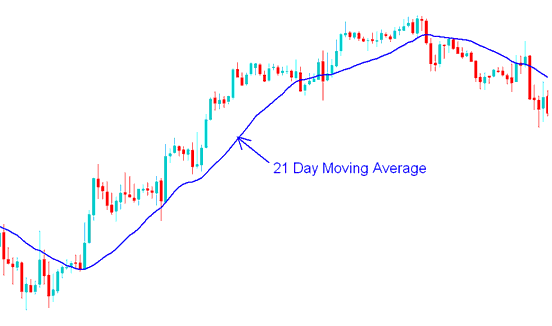

21 Day Moving Average - Moving Average Strategies Example

Learn More Topics and Lessons:

- Candlestick Patterns – Piercing Line and Dark Cloud Cover

- Locating the Nikkei 225 Stock Indices Chart within MT4

- List of Learn Forex Tutorial Guides for Beginner Traders

- How to put the GBPCAD chart on MT4 software.

- How Do I Trade Forex Using Elliott Wave Theory?

- Adding a Chart on MT4 Software: Step-by-Step Guide