Momentum Technical Analysis and Momentum Oscillator Signals

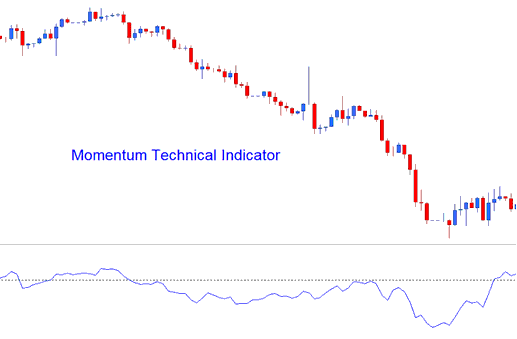

Momentum is calculated using mathematical equations to measure the speed of price changes. It is determined as the difference between the current candlestick's price and the average price from a selected number of prior candlesticks.

Momentum reflects the rate of price changes over specific time intervals. A faster price rise indicates greater upward energy, whereas a rapid decline in gold prices suggests a substantial loss of strength.

As the pace of price action decelerates, the momentum will similarly begin to wane and revert toward a central level.

Momentum

XAU/USD Analysis and Generating Signals

This indicator is employed to generate both technical buy and sell signals. The three most frequent approaches used for signal generation in XAUUSD trading are:

Zero Centerline Gold Cross Overs Signals:

- A buy signal is generated/derived when Momentum crosses above zero

- A sell signal is derived/generated when Momentum crosses below the zero level

Oversold/Overbought Levels:

Momentum spots overbought or oversold conditions. It uses past highs and lows to set those levels. This helps gauge buy or sell pressure.

- Readings above the overbought level mean the xauusd is overbought and a price correction is pending

- While readings below the oversold level the price is oversold and a price rally is pending.

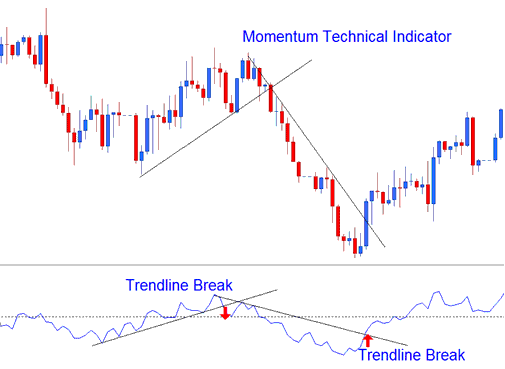

XAU/USD Trend Line Break Outs:

You can draw XAU/USD trend lines on the momentum indicator by linking the peaks and troughs. Momentum turns before price does, which makes it a great leading signal.

- Bullish reversal - Momentum readings breaking above a downward trendline warns of a possible bullish market reversal signal while

- Bearish reversal - momentum readings breaking below an upward trend line warns of a possible bearish reversal.

Technical Analysis in XAUUSD Trading

Study More Lessons and Topics:

- Setting Up Kase Peak Oscillator & Kase DevStop 2 EA

- XAU/USD and the MetaTrader 4 Market Watch: Finding Your Symbols

- Buy Long Trades: What Does "Going Long" Mean?

- GBPNOK Currency Pair

- EUR AUD Spread

- Awesome Oscillator: Buy and Sell Forex Signals Explained

- US500 Stock Indices: Strategy Guide and Lesson Download