MACD Classic Bullish & Bearish Divergence

MACD Classic divergence serves as a potential indicator signaling a forthcoming shift in market direction. This divergence technique is specifically sought out when analysts anticipate an area where the price of gold might reverse course and commence movement in the antithetical direction. Consequently, MACD classic divergence is frequently employed as a low-risk entry tactic and simultaneously as a precise mechanism for exiting an established gold transaction.

1. This approach offers a method with limited risk, targeting sales near market tops or purchases near market bottoms, thereby ensuring the potential exposure on your gold trade positions is minor relative to the anticipated profit.

2. Its function is to forecast the most advantageous level at which to terminate an already open trade position.

There are 2 categories of Classic Divergence:

- XAUUSD Classic Bullish Divergence

- XAU USD Classic Bearish Divergence

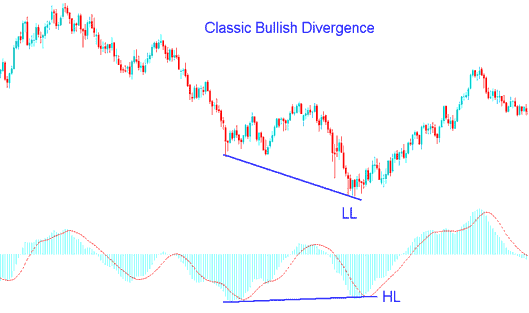

XAUUSD Classic Bullish Divergence in XAUUSD

Classic bullish divergence in xauusd appears when the price is making lower lows (LL), but the technical oscillator is making higher lows (HL).

MACD Classic Bullish Divergence in Gold - MACD Divergence XAU USD Method

Classic bullish divergence in XAUUSD hints at trend shift up from down. Prices make lower lows, but seller volume drops. The MACD shows this. It points to weakness in the gold downtrend.

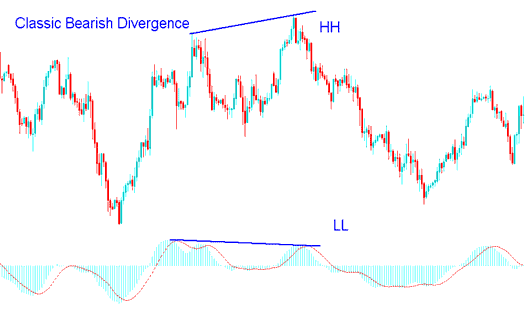

Classic bearish divergence in XAUUSD

A standard bearish divergence in XAUUSD manifests when the price exhibits a higher high (HH), while the corresponding oscillator technical indicator registers a lower high (LH).

MACD Classic Bearish Divergence in Gold - MACD Divergence XAUUSD Method

Classic bearish divergence suggests the market trend might change from rising to falling. This is because even though the price reached higher highs, the amount of buyers pushing the price higher was smaller, as shown by the MACD indicator. This shows the hidden weakness of the upward trend.

Discover More Lessons, Tutorials, and Guides

- How Do You Add Demarker Gold Indicator in Trading Chart on MT4 Platform?

- Hidden Bullish Divergence RSI FX and Hidden Bearish Divergence RSI

- What's EURAUD Pip Size?

- What is AEX25 Spreads? AEX25 Indices Spreads

- Using Strategies to Trade Effectively on Chart Patterns

- Technical Analysis Using Kase Peak Oscillator and Kase DevStop 2 Indicators

- Chande Trendscore MT4 Indicator on FX MT4 Charts

- Study FX Online Free Tutorial

- Tools That People Use To Trade the Market

- Free Live Gold Signals Platform/Software FX XAUUSD Signals Free