Evaluation of the Linear Regression Slope and Associated Linear Regression Slope Signals

The Linear Regression Slope function determines the steepness or gradient of the regression line. This calculation incorporates the current bar's gold price along with the preceding $n-1$ price bars, where $n$ denotes the total number of periods used for the regression.

This indicator consistently calculates and updates the value for each price candlestick displayed on the chart.

The Indicator is figured out using the Linear Regression Indicator. Linear regression shows where the price chart is going over a set amount of time, and this direction is found by making a Linear Regression Trend-Line using the "least square fit" way. Then, the steepness of this line is worked out, which gives the linear regression.

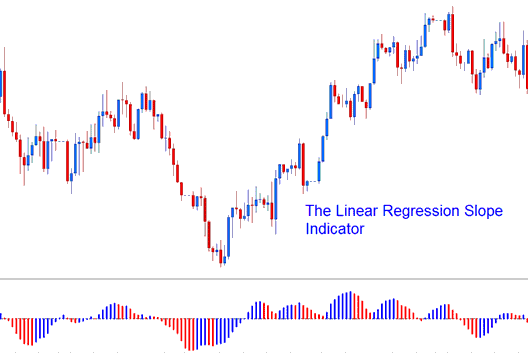

Linear Regression Slope

The slope values are then smoothed by multiplying the raw slope indicator values by 100 & then dividing this value by price

Linear Slope Regression is calculated as (raw slope value * 100 / price).

The smoothing of slope values is crucial for comparing markets characterized by volatility and significant price fluctuations on each candlestick. A smoothed slope value indicates the percentage change in price for each candlestick utilized in the regression line calculation (best fit).

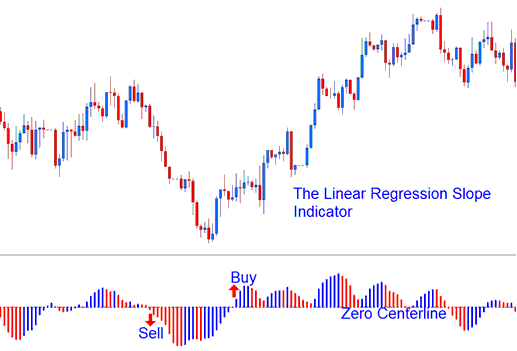

XAU/USD Analysis and Generating Signals

- If the smoothing out of the slope is 0.30, then the regression line is rising and adjusting at a rate of 0.30% for every candle.

- If the smoothing of the slope of -0.30, then the regression line is going downward & adjusting at a rate of -0.30% for every candle.

The regression slope shows up as a two-color histogram that goes up and down around the zero line. The middle line, which makes signals, is set at the 0 mark.

- A rising slope (greater than the previous value of 1 candlestick ago) is displayed and shown in the Blue/Upward Slope colour,

- A declining slope (lower than the previous value of 1 candlestick ago) is illustrated & displayed in the Red/Downwards Slope colour.

Analysis in XAU/USD

Study More Lessons and Guides: