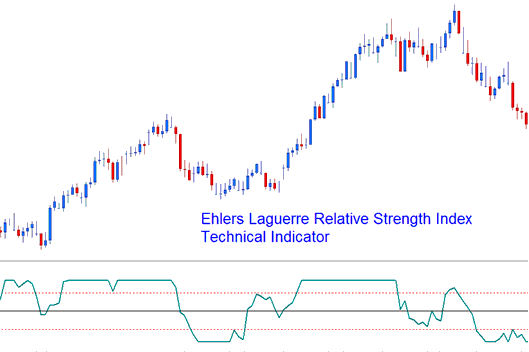

Ehler Laguerre RSI Technical Analysis and Ehlers RSI Signals

Created by John Ehler.

Originally used to trade stock and commodities.

The Ehler RSI tool uses a special filter with four parts to change the timing, so slow parts like big price changes are slowed down more than quick parts. This tool helps create better filters that use only a little bit of data.

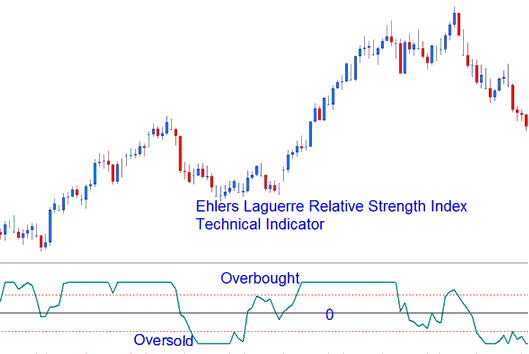

The Ehlers RSI operates on a 0 to 100 scale: signals are generated based on the central line, with the 80 and 20 levels demarcating overbought and oversold territories, respectively.

The sole adjustable parameter for this specific technical indicator is the damping gamma factor, which typically falls between 0.5 and 0.85, allowing fine-tuning to match your trading style.

Ehlers Laguerre Relative Strength Index

Technical Analysis and How to Generate Trading Signals

This implementation of the Laguerre RSI uses scale of 0 - 100.

Gold Cross-over Signals

Buy Signal - It forms when the Ehlers RSI crosses over the 50 level.

Sell signal hits when Ehlers RSI dips under 50 and the middle line.

Oversold/Overbought Levels in Indicator

Oversold/Over-bought Levels in Trading Indicator

Use Laguerre RSI to buy above 20% and sell below 80%. Watch for those crosses.

Study More Guides & Courses:

- Locating the Trading Chart for the MT4 FRA40 Index.

- What's GBP/AUD Spreads?

- The Bears Power Forex Indicator Available on the MT4 Platform

- Using Chaos Fractals to Understand Gold Charts, Explained Simply

- How Can I Utilize the ATR Indicator in MetaTrader 4?

- Overview of the Hull Moving Average

- Executing Long Buy Trades for XAUUSD and Short Sell Trades for Gold on Price Charts.