Money Management Techniques and Approaches for Trading Gold (XAUUSD)

To manage your funds well in XAUUSD trading, keep your losses smaller than your profits. That's what people mean by risk-to-reward ratio.

High Risk: Reward Ratio

This risk: reward ratio method is used to make more money from an investment plan by only trading when you could potentially make more than 3 times the amount you're risking when starting a XAUUSD trade.

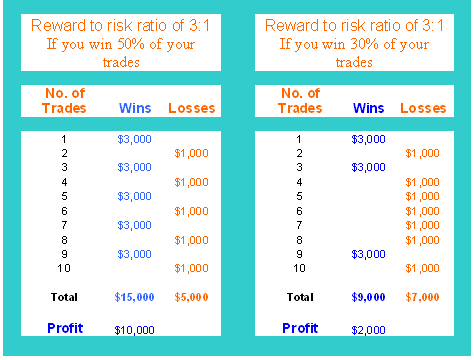

If you invest with a high risk reward ratio of 3:1 or higher, you greatly increase your chances of making money over time when trading Gold metal. The chart below shows you how this idea works:

In the first example, a 50% win rate on gold trades nets $10,000 profit. Drop to 30% wins, and you're still ahead, as the second chart shows.

Just remember, if your risk-reward ratios are good, you're more likely to make money, even if you don't win as often.

Avoid using a risk ratio where the potential loss in pips on a single trade exceeds the potential profit. It is not logical to risk $1,000 in order to only gain $100.

due to the fact you have to win 10 times extra to make $1,000 dollars lower back even if you misplaced simplest 1 trade.

As a gold trader, one loss can wipe out gains from ten wins. Manage risk to avoid this.

This trading plan fails over time. Losses are certain in the end.

% Risk Method

The percentage risk methodology involves risking the identical percentage of your total account equity balance on every single trade executed.

The risk percentage methodology dictates establishing a fixed proportion of your total trading balance that will be exposed to risk for each individual trade. To accurately determine the percentage allocated per transaction, two key figures are necessary: the predetermined risk percentage and the size of the open lot/contract. This information allows for the precise placement of the stop-loss order. Since the percentage is defined, it's subsequently utilized to calculate the appropriate lot size for the order executed in the Market - this calculation yields the position size.

Example

With a $50,000 balance and 2% risk, you can lose up to $1,000 per trade.

So 2 percent equals $1,000

If three investors purchase XAUUSD, the first one using a 100 pips stop-loss order, the second one utilizing a 200 points stop, and the third opting for a 250 points stop, their position sizes will correspond accordingly.

Example 1:

Stoploss = 100 pips

Risk % = 2 percentage = $1,000

100 pips = $1,000 dollars

1 point =1,000/100= $10

Example 2:

Stoploss = 200 pips

2 % = $1,000 dollars

200 pips = $1,000

1 point =1,000/200= $5 dollars

Example 3:

Stoploss = 250 pips

2 % = $1,000 dollars

250 pips = $1,000

1 point is calculated as 1,000 divided by 250 equals 4 dollars

Example: If a gold trader with $50,000 dollars wants to calculate the annual income from his strategy

Annual income: Let's say your strategy wins 70% of the time, your risk-reward ratio is 3:1, your stop loss is set at 100 pips, take-profit at 300 pips, and you make 100 trades each month with standard lots. Your maximum annual income will be about:

For 1 standard Gold lot profit per a pip is $1 dollars

100 transactions in 12 months equals 1,200 transactions at.

Wins & Profit

70% win: 70 % of 1,200 = 840 profitable trade transactions

840 transactions multiplied by 300 pips equals 252,000 pips.

252,000 pips = $252,000 dollars

Losses

30% Losses: 30% of 1200 Equals 360 Failed Trades

360 transactions * 100 pips = 36,000 pips

36,000 pips = $36,000

Net Profit = 252,000 - 36,000 = 216,000 pips

Earnings: 216,000 pips equals 216,000 dollars.

The example above shows possible earnings. These depend on your XAUUSD system's risk-reward ratio and its win rate.

Other factors and aspects to consider include:

Maximum Open Positions: A concluding element requiring attention is the maximum allowed count of open trade positions - meaning the highest number of concurrent trades you, as the trader, are willing to manage at one time. This critical number serves as an additional factor in your overall strategy for managing and allocating your account capital.

For instance, if you implement a risk management strategy that allocates 2% per trade position, you might also decide to maintain a maximum of 5 trade positions simultaneously. Should 4 of those trading positions close at a loss on the same day, your account equity balance would experience an 8% decline that day.

Invest with Enough Money. One big error is starting a trade account with too little cash.

A trader who does not have a lot of money to invest will be a nervous investor, who is always trying to make sure they do not lose more money than they should when trading: they will also often be forced to stop trading before they can see if their trading plan works and make money.

Be Disciplined Having self-control is the most important thing a trader can learn to make money trading gold. Self-control means being able to plan your trades and stick to that plan when trading XAUUSD.

It is the ability to let a Gold trade grow without quickly removing yourself from the market simply because you don't like the risk. Discipline also means continuing to follow your plan even after you've had some losses. Try your best to build the discipline you need to make money when trading Gold online.

Managing Trading Account Capital Basics

Money management forms the base of any XAUUSD system. It aids profits in spot gold trading online. This holds true in leveraged XAUUSD markets.

Successful investment in the online gold market requires a solid money management strategy. Utilizing leverage to open trades makes such a strategy crucial.

The difference between usual profits and losses should be carefully figured out: the average profit should be more than the average loss, or else trading Gold won't make any money. In this situation, a trader needs to come up with their own trading rules: each person's success depends on what makes them unique. Because of this, every investor makes their own plan and figures out how to handle their money, based on the rules and advice above.

When you place your gold trading orders, set your stop orders too. They protect you from big losses and can help lock in profits.

Consider the chance to get profit against loss as 3:1 - this risk:reward ratio should be more favorable on the profit side. Considering these rules and guidelines, you can use them to improve profitability of your trading strategy and try to come up with your own strategy that will possibly give you good profits.

Examine more guides and topics

- How Do I Trade Indices with MAs MAs Moving Averages MAs Example?

- Recommended and Vetted XAU USD Brokers for Conducting Trade Transactions

- Method for Saving a Workspace or Trading Strategy Configuration on the MT4 Platform

- Which is the Best Gold Leverage for XAUUSD Beginner Traders?

- How is Nasdaq100 Indices Calculated?