Analysis of the Ultimate Oscillator for Bitcoin and Corresponding Technical Trade Signals

Originally developed and used to trade stocks & commodities markets.

This oscillator tries to find a middle ground between early signals and late signals given by common technical indicators.

- Leading - some indicators lead the btcusd market and give signals earlier than the ideal optimum time

- Lagging - some indicators lag the btcusd market so far that half of the move is over before a signal gets generated.

Oscillators balance speed and delay. They aim to signal at the right moment. That's why they carry that name.

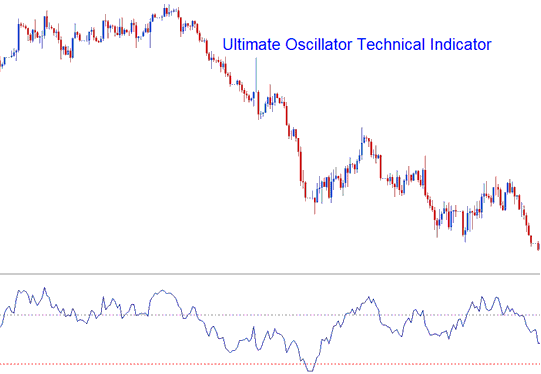

This btcusd indicator looks at 3 different candlestick patterns and calculates the combined values of bitcoin price changes from these patterns, showing the results on a scale from 0 to 100. Values above 70 are seen as overbought, and values below 30 are seen as oversold.

The ultimate oscillator considers timeframe periods of 7 (short-term), 14 (intermediate-term), and 28 (long-term) to calculate trading trends effectively.

Analysis of Bitcoin cryptocurrency and generation of trade signals

This Bitcoin technical indicator allows traders to generate buy and sell signals using varied methodologies for decision-making.

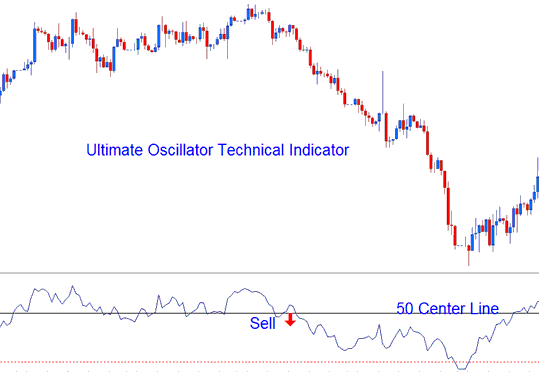

Center line Bitcoin Cross over Trade Signal

Buy Bitcoin Signal - readings above 50 center line level

Sell Bitcoin Signal - values below 50 center-line level

Center line Bitcoin Cross-over Signal

Overbought/Over-sold Levels in Trading Indicator

Over-bought - levels above 70 - sell bitcoin trading signal

Oversold - levels below 30 - buy bitcoin trading signal

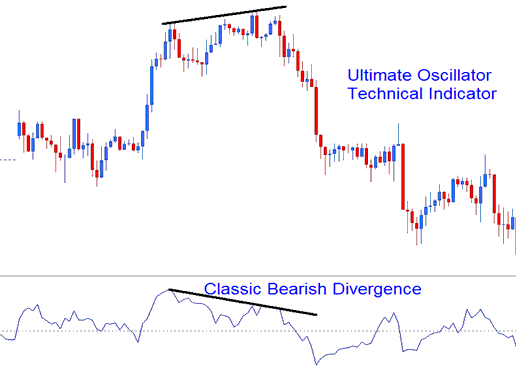

Divergence BTCUSD Trading

Oscillator-based trading can also be effectively used to identify divergence signals: an illustration of a classic bearish divergence instance follows.

Technical Analysis

More Lessons and Tutorials and Courses:

- Steps to Trade Bitcoin Head and Shoulders Setup

- RSI Hidden Divergence – Smart Bitcoin Trading Approaches

- Loading a Previously Saved Profile of MetaTrader 4 BTCUSD Charts within the MT4 Software

- Fibonacci Pullback Levels on BTCUSD Charts: A Practical Guide

- What Happens to BTC USD After an Upward Bitcoin Trendline Breaks?

- Parabolic SAR – Using It with Other Bitcoin Indicators

- Comprehensive explanation of the falling wedge price pattern.

- Day Trading: Using Support and Resistance Levels

- Using Fibonacci Pullback Levels Indicator on MetaTrader 5 Platform

- Utilizing the BTCUSD Trendline Indicator within the MT4 Bitcoin Software Suite