Bitcoin Support Resistance Analysis - S&R Trading Signals

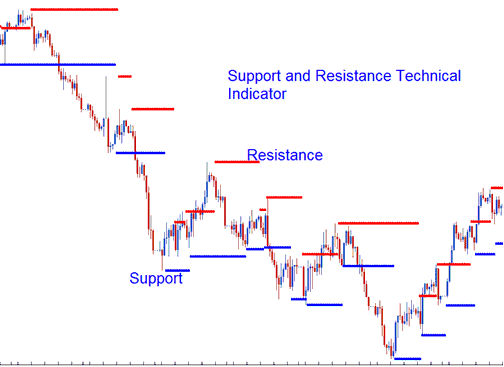

Support and Resistance are widely regarded concepts in bitcoin trading. Most traders use horizontal lines to delineate these crucial technical levels.

Additionally, an indicator exists that automatically plots these levels, highlighting the support and resistance regions.

Concerning these price levels, the bitcoin price holds the potential to either reverse course upon contact with them or break through them entirely.

If bitcoin breaks a resistance level, price rises. That level then becomes support.

If bitcoin breaks a support level, price falls further. That level becomes resistance.

Bitcoin's support levels show where most investors think prices will climb higher. Resistance levels? That's where the majority figure prices will turn lower.

Once bitcoin breaks through either a support or resistance level, it usually keeps heading in that direction until it hits the next big support or resistance zone.

The significance of a support or resistance level increases with the frequency it is tested or touched by the bitcoin price when it rebounds.

BTCUSD Analysis & Generating Signals

These levels are calculated a bitcoin trend lines method.

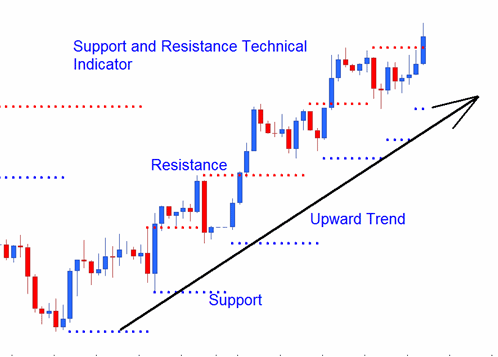

Up-ward BTCUSD Trend

In an upwards bitcoin trend the resistance & support will in general head upward

Upward Bitcoin Trend

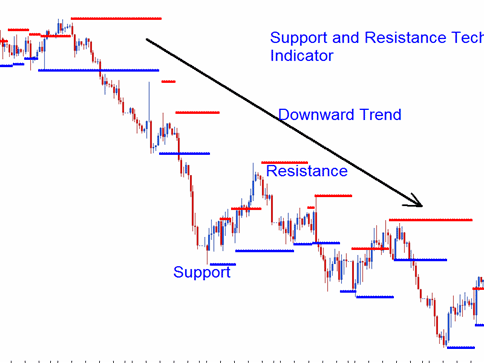

Downward BTC/USD CryptoCurrency Trend

In a downwards bitcoin trend the resistance and support will generally head downward

Downwards Bitcoin Crypto Currency Trend

Review Further Subject Areas and Directions:

- How to Day Trade BTC/USD with Pivot Points Indicator

- How to Save Open Trade Charts as a Profile in MT4 Platform

- BTC USD Trade Open Real MT5 BTCUSD Account

- Trading BTCUSD with Head and Shoulders Pattern

- How to Show BTCUSD Trading Instruments in an MT4 Training Course.

- How to Interpret and Analyze a New BTC USD Order on MT5 BTC/USD iPhone Trade App

- How Trade BTC USD with BTCUSD Trend Reversal Strategy

- Kurtosis BTC USD MT4 Indicator

- How to Interpret and Analyze Chart using Indicators

- How to draw Fibonacci extension levels when BTC/USD is trending down