RSI Hidden Bullish and Bearish Divergence on Bitcoin - Trade Setups

Hidden cryptocurrency divergence is used as a possible sign that a bitcoin trend will keep going. A hidden cryptocurrency divergence happens when the bitcoin price goes back to test a past high or low.

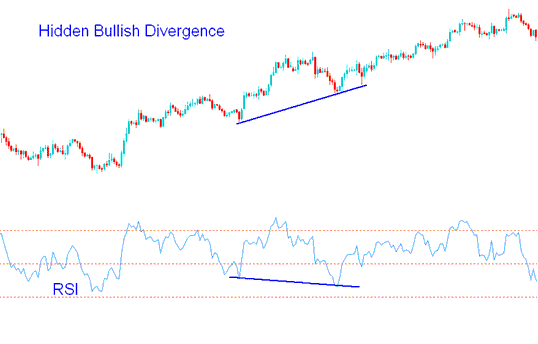

Hidden RSI CryptoCurrency Bullish Divergence

Hidden RSI bullish divergence in Bitcoin trading happens when price forms a higher low. The oscillator makes a lower low.

Hidden bullish divergence occurs when there is a retracement in a upwards trend.

RSI Bitcoin Hidden Bullish Divergence - Hidden Divergence Bitcoin Setup

This hidden cryptocurrency divergence set up confirms that a retracement move is complete. This hidden cryptocurrency trading divergence reflects underlying power of an upward trend.

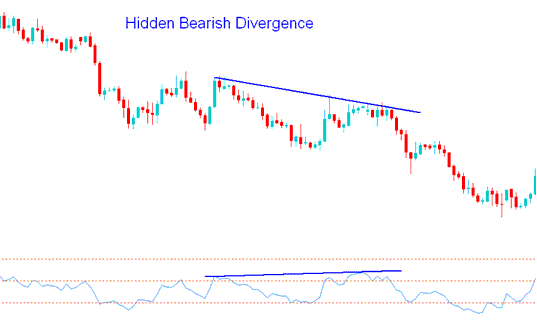

Hidden RSI Bitcoin Bearish Divergence

A hidden RSI bearish divergence in Bitcoin trading appears when the price hits a lower high (LH). Yet the oscillator shows a higher high (HH).

A hidden bearish divergence setup occurs when there is a retracement within a downward trend.

Bitcoin Hidden Bearish Divergence - A Trading Setup for Identifying Hidden Bearish Divergence in Bitcoin

This hidden bearish btcusd trading RSI set-up confirms that a retracement move is complete/exhausted. This divergence shows momentum of a downwards trend.

More Topics & Courses:

- Generating signals for Bitcoin trading step-by-step explained.

- How to Conduct Chart Analysis with Trading Systems

- How to Set a Sell Limit Order in Trading Software

- How do I open a demo BTC/USD account in MetaTrader 5?

- Procedure for Drawing a Downward Channel for BTC/USD within the MT5 Trading Software

- How do you automate BTC/USD trading with MetaTrader 4?

- Deciphering the Meaning of BTCUSD Retracement and Providing a Definition for BTC USD Retracement.

- MetaTrader 4 as a Trading Platform Solution for Cryptocurrencies

- Explaining How to Download BTC/USD MetaTrader 4 App

- Which Broker is the Best for BTC USD Micro Bitcoin Trading Accounts?