RSI for Bitcoin: Key Signals

Developed by J. Welles Wilder, this was illustrated in the book "New Concepts in Technical Trading Systems".

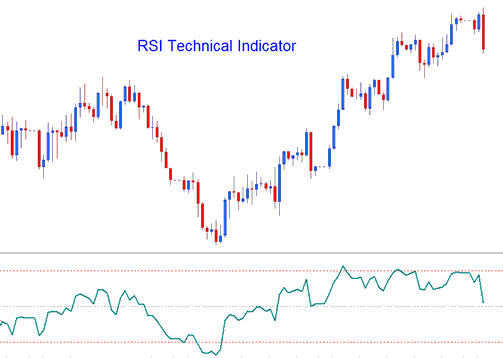

RSI tops the list of favored indicators. It acts as a momentum oscillator and trend follower for bitcoin. RSI measures recent price gains against losses. It plots them on a 0-100 scale.

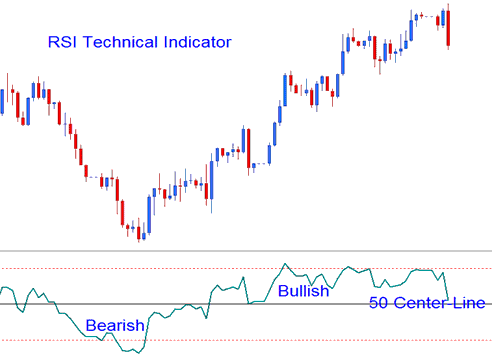

The RSI measures the momentum of bitcoin cryptocurrency: values above 50 indicate bullish momentum, while readings below the 50 centerline signify bearish energy.

- RSI is drawn as a green line

- Horizontal dashed lines are drawn to identifying over bought and oversold levels are - 70/30 levels respectively.

Bitcoin Analysis and Generating Signals

There are several different techniques used to trade, these are:

50-level Cross over Signals

- Buy trade signal - when the indicator crosses above 50 a buy/bullish signal is given/generated.

- Sell Bitcoin Signal - when the indicator crosses below the 50 center mark a sell/bearish signal is given/generated.

RSI Bitcoin Patterns

Bitcoin traders possess the capability to plot trend lines and chart formations on the RSI indicator. The RSI frequently develops cryptocurrency patterns, such as the head and shoulders formation, which may not be readily apparent on the actual bitcoin price chart.

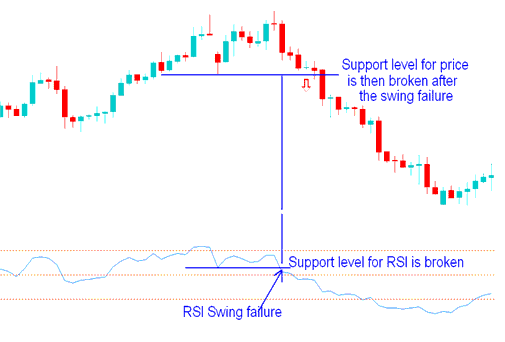

Bitcoin Support/Resistance Break outs

RSI is a sign that can help predict when prices might break through support or resistance levels. RSI uses a special signal to guess when a bitcoin price is about to break these zones.

Swing Failure - Support and Resistance Breakout

Overbought/Over-sold Conditions on Trading Indicator

- Overbought levels above 80

- Oversold - levels below 20

You can use these levels to create bitcoin signals, like buying when the RSI goes up from below 20 after being oversold, and selling when the RSI goes below 80 after being overbought. These signals are not good for Bitcoin because they often cause false alarms.

Divergence Bitcoin Trade Setups

Divergence trading is a way to figure out when bitcoin price trends might change direction. There are four kinds of divergences you can trade with, and they're explained in the divergence guide on this website, using the trading indicator discussed.

Learn More Tutorials & Topics:

- Tutorial Lesson on Executing Bitcoin Trades Using the MetaTrader 4 Chart

- VPS Hosting for EA BTC/USD

- MACD Line Crossover Signal Trade System

- How to Understand What MetaTrader 5 Chart Signals Mean for New Traders: A Guide

- How to Trade Consolidation Setups

- Hanging Man as Bearish BTC USD Pattern

- Learning to Use MetaTrader 5 for BTC/USD

- Multiple Time-frame Analysis in BTC USD Trading

- How to understand what BTC USD trading candle shapes mean with BTC USD plans.

- Bitcoin After a Bear Flag – What Comes Next?