MA BTCUSD Analysis and Moving Average Trade Signals

This tool finds the average bitcoin price over a set time frame.

The main change in MA types comes from how they weight new data. Simple MAs treat all bitcoin prices the same. Exponential and weighted ones favor fresh prices more.

Explanation

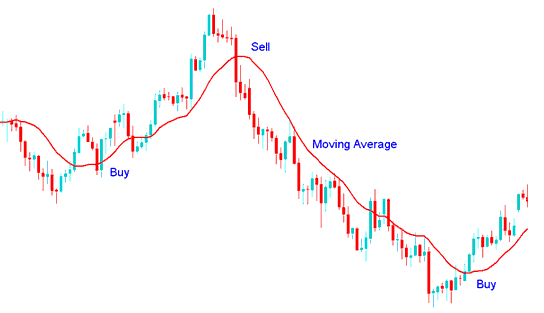

The most common method for analyzing the MA involves scrutinizing the relationship between Bitcoin's price and its corresponding moving average. A buy signal for cryptocurrency arises when the Bitcoin price ascends above its MA, conversely, a sell signal is generated when the price declines and drops below this same MA.

Moving Average Technical Indicator

Buy and Sell Bitcoin Signals are generated by the Moving Average (MA) crossing above or below the bitcoin price action.

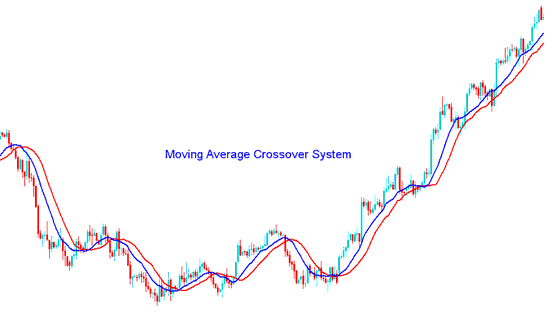

MA Cross over Method

Also popular are different types of MA cross over strategies. Such strategies often include 2 or more moving averages crossing above/below each other and perhaps even using other indicators as additional entry and exit confirmation signals. Combinations of conditions for these types of systems are almost limitless.

Moving Average Cross over System

Study More Courses:

- What steps do you take to set up the William % R indicator in MetaTrader 4 for trading BTC USD?

- How Do You Set Up Fibonacci Pullback BTC USD Measurements in MetaTrader 4 Program?

- Understanding Swap-Free Bitcoin Trading Accounts

- What Will Happen to BTCUSD Prices After the Rising Wedge Happens?

- BTC/USD App Download for iPad

- How to Draw **FiboFibonacci Extension Levels on Downwards BTC USD Trend

- Learn the BTC/USD money management strategy here.

- How do you catch the major market movers and news reports?

- How do you adjust Bitcoin chart options in MetaTrader 4's Tools menu?

- Technique for Charting Fibonacci Extension Levels within a Downwards BTC USD Trend Structure?