MACD Bitcoin Hidden Bullish & Bearish Divergence

BTCUSD traders use MACD hidden divergence on bitcoin to spot signs of trend continuation.

This configuration of MACD Bitcoin Hidden Divergence arises when the Bitcoin price pulls back to re-examine a prior high or low point. There exist two distinct types of MACD Bitcoin Hidden Divergence trade setups:

1. BTCUSD Hidden Bullish Divergence Trade Setup

2. BTCUSD Crypto Hidden Bearish Divergence

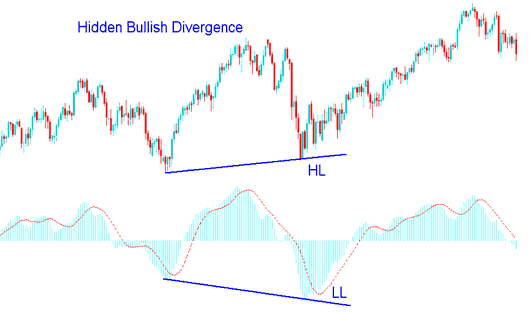

Bitcoin Trade Hidden Bullish Divergence in Bitcoin Trading

The MACD Bitcoin Hidden Bullish Divergence formation appears if the cryptocurrency price for Bitcoin establishes a higher low (HL), yet the MACD indicator registers a lower low (LL).

A hidden bullish divergence setup occurs during a retracement in an upward trend.

A Bitcoin Trading Strategy Built Around MACD Bullish Divergence – Setting Up Trades Based on MACD Bullish Divergence.

This MACD bullish divergence in bitcoin confirms the pullback has ended. It shows strength in the uptrend.

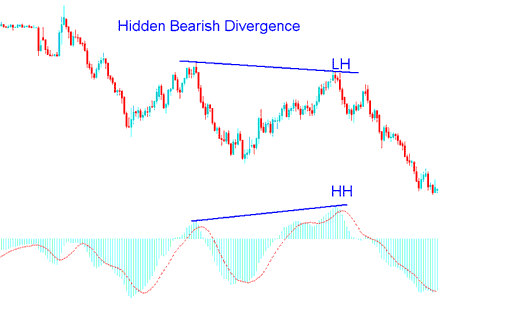

Bitcoin Hidden Bearish Divergence in Bitcoin Trading

A MACD Bitcoin Hidden Bearish Divergence trade setup happens when the bitcoin price is making a lower high (LH), but the MACD oscillator trading is showing a higher high (HH).

A hidden bearish divergence setup forms when there is a retracement in a downward trend.

MACD Bearish Divergence Strategy for Bitcoin - Setup for Bearish Divergence Using the Bitcoin MACD Indicator.

This MACD hidden bearish divergence shows a price pullback ends. It points to building downward momentum.

Note: Hidden divergence works best for crypto trades. It signals in line with the BTCUSD trend. It offers top entry points. It beats classic divergence for accuracy in bitcoin signals.

Learn More Topics and Courses:

- BTCUSD Price Action Trading Strategies List

- BTC/USD trading: online course and step-by-step learning

- Learning to Trade with MetaTrader 5: Where to Begin

- Understanding Fibonacci Pullback Levels

- Tips for stochastic analysis and BTC/USD strategies.

- Step-by-Step Guide on Drawing BTCUSD Channels Within the MetaTrader 4 Software.

- Step-by-Step Instructions for Configuring a Bitcoin Trading Chart Layout in MetaTrader 4 Software

- How to Use Fibonacci Pullback Levels on MetaTrader 5 Program?

- Understanding the Inverted Hammer and Shooting Star Candle Patterns

- Engaging in Bitcoin Trading: Buying and Selling the Crypto Instrument in BTCUSD