Application of the Kaufman Efficiency Ratio for Bitcoin Analysis and Resulting Trade Signals

developed by way of Perry Kaufman. explained in his book entitled "New buying and selling strategies & strategies".

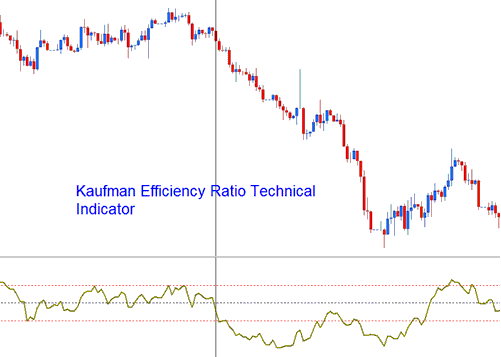

The Kaufman Efficiency metric quantifies the market's relative speed in relation to its inherent volatility. BTCUSD traders frequently employ Kaufman Efficiency as a screening tool to circumvent periods where the BTCUSD market displays "choppy" characteristics or remains confined to flat, range-bound trading. Furthermore, this indicator aids in identifying smoother Bitcoin market trends. It functions by oscillating between +100 and -100, with 0 serving as the midpoint. A reading toward +100 indicates an upwardly trending market, whereas a reading toward -100 signifies a downward trend.

Kaufman Efficiency Ratio

The Efficiency indicator is found by dividing how much the bitcoin price changes over a certain time by the total of all the bitcoin price changes between each bar during that same time.

Bitcoin Analysis and How to Generate Trading Signals

Kaufman is used to generate trade signals as follows:

The smoother the manner in which the btcusd market is trending then the greater the Efficiency Ratio displayed and illustrated by indicator. Efficiency Ratio values/readings of around zero show a lot of inefficiency or "choppiness" in the btcusd market bitcoin trend movements (ranging markets).

- If the Efficiency Ratio shows a reading of +100 for bitcoin crypto, then bitcoin is trending upward with perfect efficiency.

- If the Efficiency Ratio shows a reading of -100 for bitcoin crypto, then that bitcoin price is trending downwards with perfect efficiency.

But, it is almost impossible for a market bitcoin trend to be perfectly efficient, because any small move against the current bitcoin trend direction during the time being used to figure out the technical indicator would make the efficiency ratio lower.

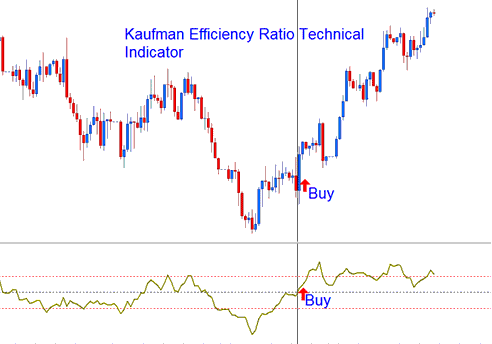

Bullish/Buy Signal

Efficiency Ratio values/readings above +30 indicate a smoother upward trend.

Buy signal gets derived/generated above centerline mark.

Buy Signal

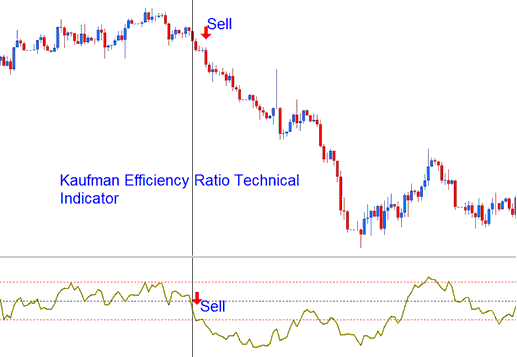

Bearish/Sell Signal

Efficiency Ratio values/readings below -30 indicate a smoother downwards trend.

Sell Bitcoin Signal is generated below zero center line mark.

Sell Signal

Test different settings to find what works best for your bitcoin trades. Match them to your strategy for better results.

Get More Tutorials & Courses:

- How to Calculate Leverage and Margin When Trading Bitcoin

- Strategies for Bitcoin Scalping Trading

- How Do You Set MT5 BTC USD Market Facilitation Index Technical Indicator in MT5 Platform Software?

- How do you trade a chart using a Bitcoin trend reversal strategy?

- Overview of the BTCUSD Trading System

- How to Use MT4 Bitcoin Trading Demo Account

- Saving and Using Templates in MetaTrader 4 Charts

- A Tutorial Guide on Deploying Fibonacci Pullback Levels on BTCUSD Charts

- Bitcoin Candlesticks – Types of Reversal Patterns

- Learning How to Effectively Use the MetaTrader 4 Online Bitcoin Software