How to Bitcoin Trade Reversal Bitcoin Setup

Reversal patterns show when the bitcoin market trend is changing direction once we see confirmation of this reversal Bitcoin crypto pattern.

How to Interpret and Analyze Reversal Bitcoin Patterns

Reversal patterns in Bitcoin crypto appear after long trends up or down. They warn that the BTCUSD trend may soon change direction.

Reversal BTC USD Trading Patterns

- Double Top Bitcoin Reversal Bitcoin Patterns

- Double Bottom Bitcoin Reversal Bitcoin Patterns

- Head and Shoulders Bitcoin Reversal Bitcoin Patterns

- Reverse Head and Shoulders Bitcoin Reversal Bitcoin Patterns

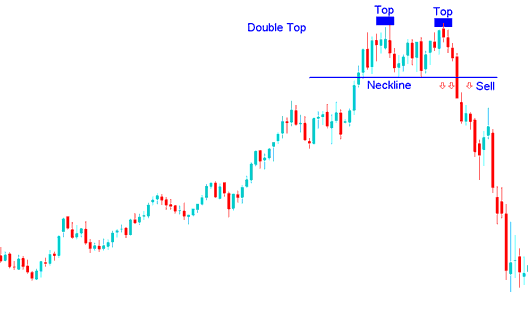

Double Top BTCUSD Trading Pattern Analysis

The double tops setup in cryptocurrency is a pattern signaling a potential reversal following a prolonged upward movement in crypto assets. As the name suggests, this formation consists of two sequential crests that are nearly identical in height, separated by a moderate valley.

How to Analyze Double Tops Reversal Bitcoin Patterns

A double top pattern in crypto finishes when bitcoin hits a second peak and drops below the neckline. The neckline is the low point between peaks. Sell when prices break below it.

In BTCUSD Crypto, the double tops pattern is an early sign that Bitcoin's upward movement may soon change direction. However, confirmation happens only when the neckline breaks and the btcusd market falls below that neck-line. Neck-line is simply another way of naming the most recent support area on the chart.

Summary:

- Double tops btcusd crypto setup forms after an extended move upward

- Double tops cryptocurrency pattern formation demonstrates that there will be a reversal in btcusd market

- We sell when btcusd crypto price breaks-out below the neckline point: see below for explanation.

How Do I Interpret Double Tops Reversal Patterns? - Double Tops Analysis

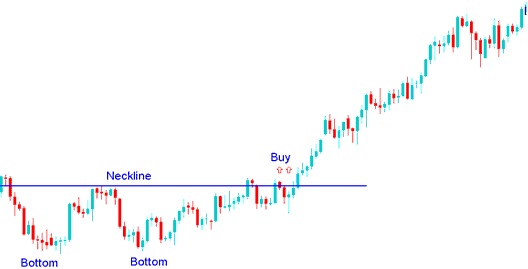

Double Bottom BTCUSD Trading Pattern Analysis

The double bottom is a reversal pattern observed in cryptocurrency charts, typically manifesting after a prolonged downward trend in cryptocurrency prices. It is visually constructed from two successive troughs of similar height, separated by a moderate intermediate peak.

How do you analyze and interpret double bottoms as reversal patterns in Bitcoin?

Double bottom cryptocurrency pattern formation is considered complete once bitcoin price makes second low & then penetrates the highest point between lows, known as the neckline. The buy indication from this bottoming out signal occurs and happens when the bitcoin cryptocurrency market breaks the neckline to the upside.

In BTCUSD Crypto, double bottoms cryptocurrency setup setup formation is an early signal that the bearish Bitcoin trend is about to turn and reverse. It's only considered complete/confirmed once the neckline is broken. In this formation the neck-line is the resistance area for the bitcoin cryptocurrency price. Once this resistance is breached and broken the btcusd crypto market will move upwards.

Summary:

- Double bottom btcusd crypto pattern setup formation forms after an extended move downwards

- Double bottom cryptocurrency pattern formation demonstrates that there will be a reversal in btcusd market

- We buy when btcusd crypto price breaks above the neck-line point: see below for an explanation.

How Do I Analyze Double Bottoms Reversal Bitcoin Setups? - Double Bottoms Analysis

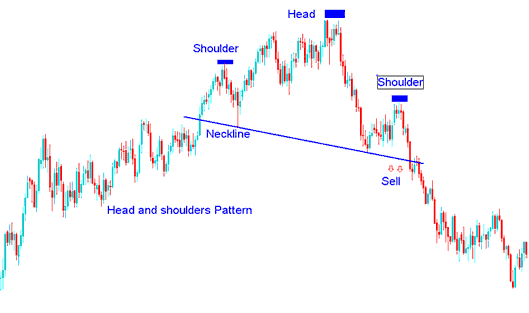

Head and Shoulders BTCUSD Trading Pattern Analysis

The head and shoulders pattern in crypto charts signals a turn. It comes after a long uptrend in bitcoin. It has three peaks: left shoulder, head, right shoulder. Two dips sit between the shoulders.

Read and Analyze Head and Shoulders Bitcoin Reversals

The head and shoulders pattern in cryptocurrency charts becomes complete when Bitcoin's price breaks below the neckline line, which is drawn by connecting the two troughs formed between its shoulder levels.

To go short, BTC/USD Crypto traders set their sell stop bitcoin orders just below the neck-line.

Summary:

- Head and Shoulders bitcoin pattern forms after an extended move upward

- Head and Shoulders cryptocurrency pattern formation demonstrates that there will be a reversal in btcusd market

- Head and Shoulders bitcoin pattern formation resembles and looks like a head with shoulders thus its title.

- To draw the neckline we use chart point 1 & point 2 like as shown below. We also extend this line in both directions.

- We sell when bitcoin price breaks-out below the neckline point: see the chart below for explanation.

Analysis of Head and Shoulders Reversal Setups for Bitcoin Trading – Head and Shoulders Pattern Analysis

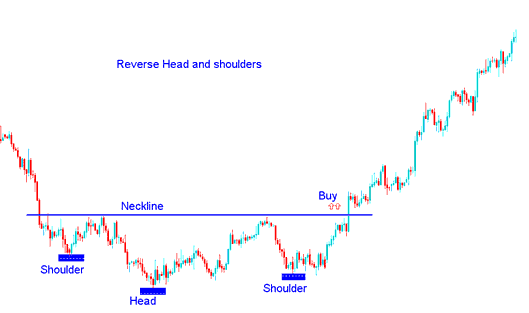

Reverse Head and Shoulders BTCUSD Trading Pattern Analysis

The Reverse Head and Shoulders pattern in cryptocurrency charts is a reversal setup that emerges after a prolonged Bitcoin downturn. It resembles an inverted head and shoulders.

How to Interpret and Analyze Reverse/Inverse Head and Shoulders Reversal Bitcoin Patterns

The completion of the Reverse Head and Shoulders chart pattern in cryptocurrency analysis is confirmed when the price of Bitcoin breaks decisively above the neckline, which is the line connecting the two peaks situated between the pattern's inverted shoulder formations.

To go long buyers/bulls place their buy stop btcusd orders just above the neck-line.

Summary:

- Reverse Head and Shoulders bitcoin pattern forms after an extended move downwards

- Reverse Head and Shoulders cryptocurrency pattern formation demonstrates that there will be a reversal in btcusd market

- Reverse Head and Shoulders cryptocurrency chart pattern formation resembles upside down, thus the name Reverse.

- We buy when bitcoin price breaks above the neckline point: see the chart below for an explanation.

Understanding the Inverse Head and Shoulders Reversal Patterns for Bitcoin - An Analysis of the Inverse Head and Shoulders

Guidance on Interpreting Cryptocurrency Reversal Setups - BTC Chart Patterns Indicating Reversal

Further Subject Areas & Resources:

- Consolidation Trading Indicator Bitcoin Cryptocurrency

- What Happens in BTC USD Trade after a Bull Flag Pattern?

- How Do I Use MetaTrader 4 Bitcoin Platform Software Data Window BTC USD MT4 Data Window Tutorial Course?

- How Do I Use Buy Stop Order on Platform Software?

- How Do I Analyze BTCUSD Divergence Trade Setup?

- Setting Stop Loss for BTC/USD in MetaTrader 5 iPhone App

- How Do I Draw BTC USD Channels in MT4 BTCUSD Charts?

- How to Interpret and Analyze Downwards BTCUSD Trend-Lines in BTC/USD Charts

- MT4 Trade Platform Tutorial Course Described

- How Do You Trade BTC USD Divergence Trade Setup?