Divergence MACD Classic Bullish and Bearish Setups

MACD Classic divergence trade setup is used as a possible sign for a bitcoin trend reversal. Classic divergence trade setup is used when looking for an area where bitcoin price could reverse and ==22==beginstart going in the opposite market direction. For this reason classic divergence is used as a low risk entry strategy & also as an accurate to exit of a trade transaction.

1. It is a low risk strategy to sell near the btcusd market tops or buy near the btcusd market bottoms, this makes the risk to your trade transactions are very small in relation to potential reward.

2. It is used to predict the optimum ideal level at which to exit a Bitcoin trade.

There are 2 types:

- Bitcoin Classic Bullish Divergence Trading Setup

- Bitcoin Classic Bearish Divergence Trade Setup

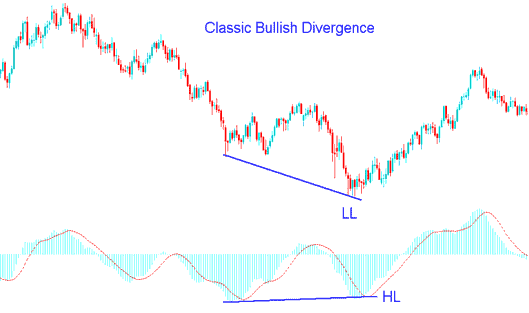

BTCUSD Classic Bullish Divergence Trading Setup

Classic bullish divergence occurs when bitcoin price is forming/making lower lows (LL), but the divergence macd technical indicator is forming/making higher lows (HL).

Divergence MACD Classic Bullish

Classic bullish divergence pattern warns of a possible change in bitcoin trend from downward to upwards. This is because even though the bitcoin market price went lower the volume of the sellers who pushed bitcoin price lower was less like illustrated by MACD. This is an indicator of the under-lying weakness of the downward trend.

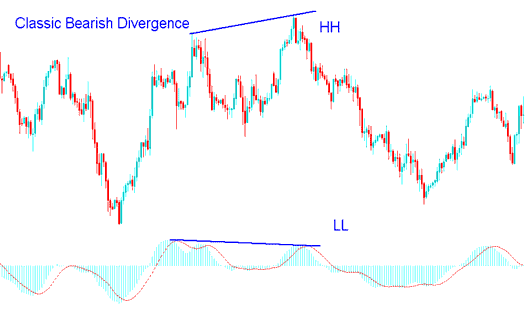

Classic bearish Bitcoin Trade Divergence Trading Setup

Classic bearish divergence setup occurs when bitcoin price is forming/making a higher high (HH), but the divergence macd technical indicator is lower high (LH).

Divergence MACD Classic Bearish

Classic bearish divergence trading pattern setup warns of a possible change in the bitcoin trend from upward to downwards. This is because even though the bitcoin market price went higher the volume of the buyers who pushed bitcoin price higher was less like as illustrated by the Divergence MACD indicator. This is a indicator of the underlying weakness of the upwards trend.

Divergence MACD Hidden Bullish and Bearish Setups

MACD Hidden divergence is used as a possible sign for a bitcoin trend continuation.

This divergence trade setup occurs when bitcoin price retraces to retest a previous high or low.

1. BTCUSD Hidden Bullish Divergence

2. Bitcoin Hidden Bearish Divergence Trade Setup

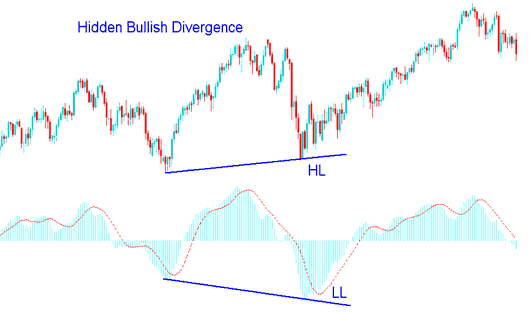

BTCUSD Hidden Bullish Divergence

Forms when bitcoin price is making a higher low ( HL ), but the MACD oscillator is showing a lower low (LL).

Hidden bullish divergence setup occurs when there's a retracement in an upward trend.

Divergence MACD bullish

This divergence confirms that a price retracement move is complete. This divergence demonstrates under-lying strength of an upwards trend.

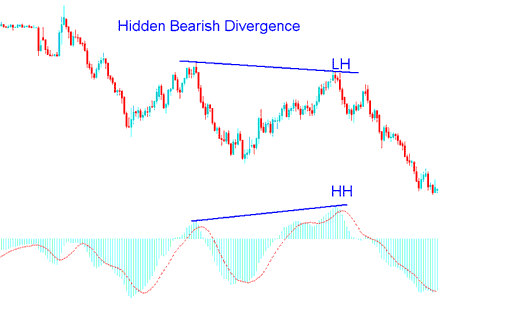

Bitcoin Hidden Bearish Divergence Trade Setup

Forms when btcusd cryptocurrency price is forming/making a lower high (LH), but MACD oscillator trading is showing a higher high (HH).

Hidden bearish divergence trade setup occurs when there's a retracement in an upwards trend.

divergence MACD bearish

This divergence trade set-up confirms that a price retracement move is complete. This diverging reflects the under-lying momentum of a ==22==downwardsdownward trend.

Get More Tutorials & Topics:

- How to Set Trade Trailing Stop loss Trading Indicator on Trading Chart

- How to Add a BTC/USD Market Execution Order in MT4 Software Platform

- How to Learn BTC/USD Platforms for Mobile Phones

- How to Trade with One-Click BTC/USD Trading on MT5 Software

- Trailing Stop Loss BTC/USD Order Levels Indicator Analysis

- How to Trade in Bitcoin Where to Place a Stop Loss BTC USD Order

- How Can You Analyze/Interpret a New BTCUSD Order in MetaTrader 4 Android App?

- How to Load BTC/USD MT4 Trading Chart Template on MT4 Software Platform

- Ultimate Oscillator BTC USD MT4 Technical Indicator Ultimate Oscillator

- How to Hide BTCUSD ==22==SymbolsQuotesSymbols/Quotes in MetaTrader 4 Explained