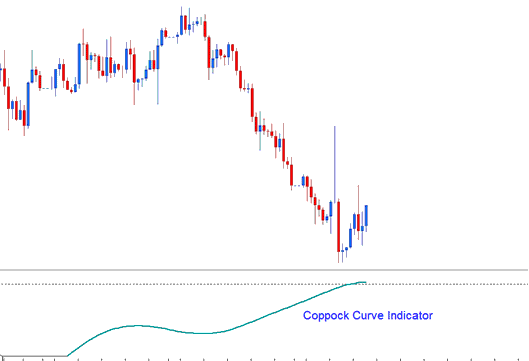

Coppock Curve Bitcoin Analysis and Coppock Curve Signals

Developed by Edwin Sedgwick Coppock

This btcusd indicator was originally used to analyze Stocks & Commodities, but later it was used to trade Bitcoin.

This is based on the idea that people act predictably when trading, which means that human behavior is predictable, and the bitcoin price always moves up and down in a zigzag way.

The adaptation-level principle basically means that bitcoin's price reacts to certain levels just like it always has. It's the same story with stocks - prices tend to behave in familiar ways whenever they hit those key points.

Bitcoin Crypto Currency Analysis and How to Generate Signals

In Bitcoin trading, the moving average serves as a fundamental adaptation method: the Bitcoin price fluctuates around it, forming the foundation for this technical indicator. This oscillator is longer-term and based on moving averages, although it is applied differently.

Oscillators usually start by figuring out a percentage change in the current bitcoin price from a past bitcoin price, using the past bitcoin price as the reference.

Edwin Coppock thought that you could measure how btcusd market participants are feeling by adding and adding up the recent percentage changes to get a general idea of how the btcusd market is trending over a longer time.

Looking at Bitcoin prices over a year reveals growing momentum in the BTCUSD market. This month saw a 20% rise from last year. Earlier months showed steady gains of 15%, 10%, 7.5%, and 5%.

Simple signals can also come from using the Coppock Curve to make trades when the bitcoin market changes direction from very high or low price points. Watching for differences and bitcoin trend line breaks might also be used to double-check the signal.

Implementation

Adjust the input levels of this indicator to match the changing patterns in btcusd market trades.

The Coppock Curve features a reference line at zero: however, this line does not indicate adaptation levels, serving merely as a visual aid.

Discover Extra Subjects & Instructions:

- BTC USD Trade Psychology Explained

- How to Interpret and Analyze MT5 Fibonacci Extension in MT5 Platform

- How Do I Determine BTC USD Trend & How to Determine BTC USD Trend Strength & Momentum?

- How Do I Identify Bitcoin Trends in BTC USD Charts?

- Intraday Trading Bitcoin Trend-Lines BTC USD Strategy

- How Much Money Does it Cost to Register a Standard Bitcoin Account?

- Employing a Combination of the Gator Indicator with BTC USD Trades for BTC USD Transactions

- How Do I Interpret Different Types of Divergence Trade Signal?

- Risk Management Strategy BTCUSD Trade

- Best CCI for 15 Min BTC USD Chart