Synthesis of Price Action Methodology with Other Cryptocurrency Analysis Indicators

Good bitcoin indicators to combine bitcoin price action strategy with are:

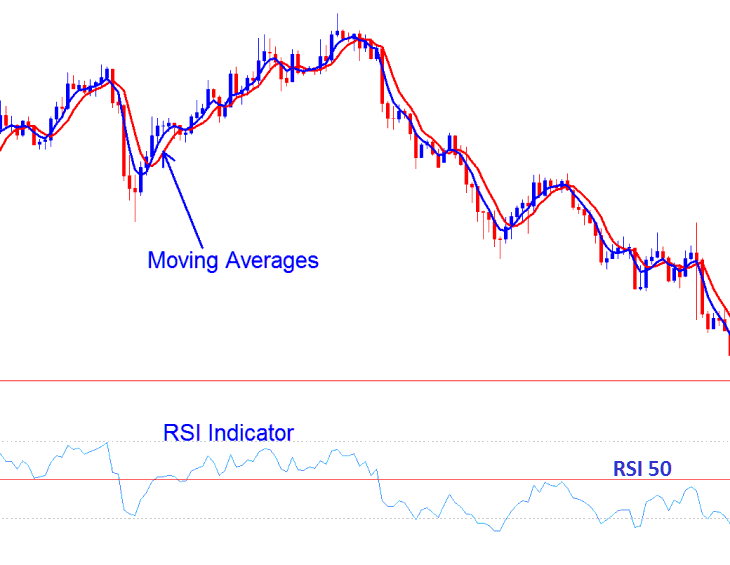

- RSI

- Moving Average Indicator

Investors and traders pick these two Bitcoin tools. They check if breakout moves match the overall BTCUSD trend these show.

If bitcoin's price breaks out in the same direction as the RSI and the Moving Average, traders can go ahead and open a trade in that direction. But if the indicators don't line up, it's better to stay out - there's a higher risk the signal's just a fakeout, or a whipsaw.

Just like any other technical indicator in bitcoin trading, bitcoin price action also has whipsaws and there a requirement to use this as a combination with other signal trade setups as opposed to just using this strategy alone. This combination of trade set ups forms a bitcoin price action system strategy that bitcoin traders can use to generate bitcoin signals with.

RSI & MAs with Crypto Price Action Method - Crypto Price Action System

What is BTC/USD Crypto Price Action Trading Strategy?

A Bitcoin Price action bitcoin strategy is when you only use bitcoin price charts to trade bitcoin, and you don't use any chart technical indicators.

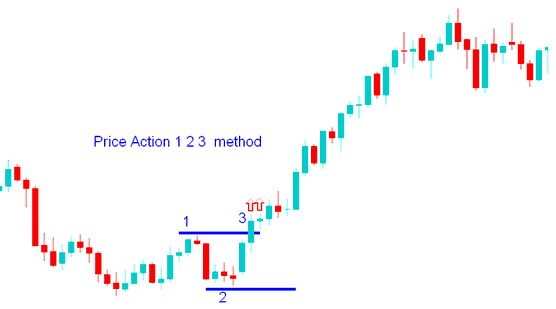

This bitcoin price action strategy uses candlestick charts. It relies on lines and set patterns, like the 1-2-3 pattern. These can form alone or in a series for trades.

Traders use bitcoin price action patterns strategy because this bitcoin price action analysis is very objective & allows a trader to analyze btcusd market bitcoin price moves based on what they see on the bitcoin price charts alone.

Bitcoin Price action bitcoin patterns are used by many bitcoin traders: even those that use indicators also integrate some form of bitcoin price action strategy in their overall bitcoin system like in the exemplification laid-out above.

Combine this bitcoin price action with line studies for best results. It adds confirmation. See the example in the bitcoin system.

BTCUSD Price Action 1 2 3 Breakout Pattern

This btcusd crypto price action 1 2 3 strategy uses 3 points to figure out the break out direction of btcusd crypto price action.

The 1-2-3 bitcoin price action method uses a peak and trough. These make points 1 and 2. If price breaks above the peak, it's a buy signal. If it drops below the trough, it's a sell signal. The breakout from point 1 or 2 creates point 3.

Crypto Price Action Strategy - Crypto Price Action Patterns

Explore Further Instruction Sets & Programs:

- BTC/USD Day Strategies Using Bitcoin Trading Indicators

- How Do I Analyze & Login to MetaTrader 4 Trade Platform?

- Add Moving Average Oscillator for Bitcoin Trades on BTC USD Charts

- Head and Shoulders BTC USD Candles Described

- Analysis of BTC USD Parabolic Trends & Bitcoin Momentum Trends

- How to Add Trading Market Facilitation Index Indicator in Chart

- Interpreting and Analyzing BTC/USD Trade Systems

- What's BTC USD Trade & How Does it Work?

- Steps for Setting Up the Online MT4 BTC/USD Software