Bitcoin Pin Bar Pattern with Fibonacci Retracement Indicator Setups

These pin bar bitcoin crypto price action setup set-ups are often developed near extremes in market swings, and they often happen at after false breaks-outs. This is why this pin-bar btcusd price action pattern is used to place trades in the opposite direction of the tail of this btcusd crypto price action setup.

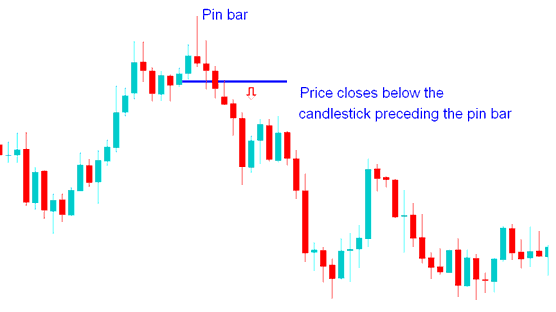

A pin bar bitcoin price action setup shows a clear reversal on the chart. It's an obvious sign that market sentiment has shifted during that trading session.

This pin bar candlestick has a long tail with the closing bitcoin price near the open. The pin bar candlestick looks like a pin thus the name Pin Bar - forms after an extended trend move up or down.

Guidance on Trading Price Action Setups Combined with Fibonacci Retracement Levels Indicator

This bitcoin price action reversal signal for crypto confirms after the market closes below the candle before the pattern.

The Bitcoin price action reversal pattern, specifically the pin bar setup, is confirmed once the BTC/USD market closes below the blue candle that preceded the pin bar candlestick formation.

What is the method for trading price action pattern setups using Fibonacci Retracement Levels as a technical indicator?

Combining the Pin Bar Price Action Pattern with Fibonacci Retracement Zones for Trading Decisions

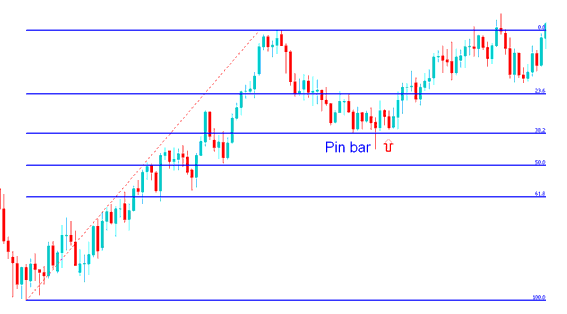

This pin bar bitcoin btcusd price action setup signal can be used with other line studies like Fibonacci retracements to create bitcoin buy or sell signals.

These pin bar bitcoin crypto price action setup set-ups are often developed near extremes in market swings, & they often happen at after false breaks-outs. This is why this pin-bar btcusd price action pattern is used to place trades in the opposite market direction of the tail of this btcusd crypto price action setup.

BTCUSD Trading Fibonacci Retracement Areas

Pin bars in the bitcoin price that show up after the bitcoin price touches/tests a Fibonacci retracement level can also be used as signs to get into the bitcoin market.

Crypto Pin Bar Price Action Setup Indicator Combined with the Fibonacci Retracement Levels Indicator

These pin bar btcusd price action setup patterns are often developed near extremes in market swings, and they often occur after a false break outs of bitcoin price action.

Because of this, the reversal bitcoin price action pattern is applied when making cryptocurrency trades that go against the trend shown by the pin-bar candle's tail.

More Courses & Guides:

- BTC USD Broker Account with Account Opening Bonus

- Reviewing Bitcoin Pending Orders within the MT4 Trading Environment

- McClellan Histogram Bitcoin Indicator Analysis in BTC USD

- How do I interpret the technical setups of BTC/USD patterns as described?

- How Do You Trade Use Learn MT5 Mobile Trade Android App Tutorial Guide?

- How to Interpret and Analyze MT4 Bitcoin Pending Orders in MT4 Platform Software

- Executing Fibonacci Extension Drawings for BTC USD Trades

- How to Interpret and Analyze MT5 CryptoCurrency Fibo Extension Trading Indicator on MT5 Platform

- How to Trade with MT5 BTCUSD Demo Account Practice MT5 Bitcoin Demo Tutorial Lesson

- What Happens in BTC USD Trade after a BTCUSD Setup Breakout?