BOP Bitcoin Analysis & Balance of Power Signals

Developed by Igor Livshin

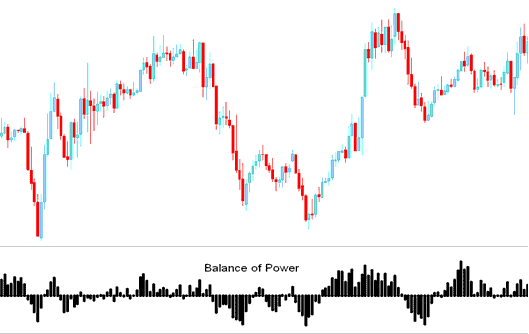

The BOP indicator checks bull strength against bears. It looks at how each pushes Bitcoin price to extremes.

BTCUSD Analysis and How to Generate Trade Signals

When using this indicator, zero line crossovers are used to generate bitcoin signals.

Center is marked as the zero line, areas oscillating above or below are used to generate bitcoin signals.

Buy - The scale is labeled from 0 to +100 for bullish movements

Sell Indication - The Measurement Scale is Segmented and Marked from Zero Down to -100 to Denote Downward Price Movement

How to Generate Buy & Sell Trading Signals

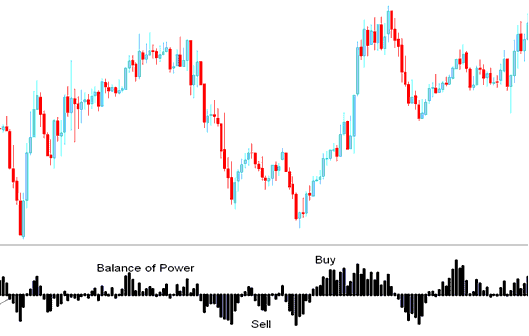

Buy Signal

When the Balance of Power BOP crosses above 0 a buy btcusd signal is given.

Also, when the BOP goes up, the bitcoin crypto market usually goes up too: some traders see this as a signal to buy cryptocurrency, but it's better to wait for the indicator to go above zero for confirmation. This will be a crypto buying signal in a losing market, and this type of trading signal is more likely to be a btcusd crypto false alarm.

Sell Trade Signal

When the (BOP) crosses below 0 a sell bitcoin signal is generated.

When the BOP shows a downward movement, it indicates that the btcusd cryptocurrency market is also experiencing a decline. Many traders interpret this scenario as a sell signal for their crypto assets; however, it is advisable to remain patient until a confirmation signal is received by dropping below the zero line. This indicates a selling opportunity in a bullish market, and such signals often lead to bitcoin whipsaw fakeouts.

Sell & Buy Signals

Divergence BTC USD Crypto Trading

When trading bitcoin, looking at the differences between the BOP and the bitcoin price can be helpful to find possible turning points or spots where the bitcoin price movement might keep going in the same way. There are different kinds of differences that you can find:

Classic Divergence - Bitcoin Trend reversal bitcoin signal

Hidden Divergence - Bitcoin Trend continuation

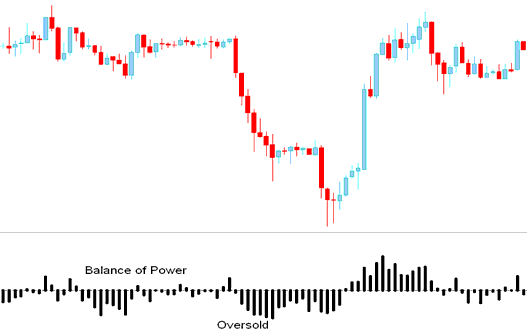

Bitcoin Overbought and Oversold Conditions

This BOP serves to identify potential overbought and oversold conditions in the movement of bitcoin prices.

- Overbought/Oversold levels can be used to provide an early signal for potential bitcoin trend reversals.

- These levels are derived & generated when the indicator clusters its tops and bottoms thus setting up the overbought & over-sold levels around those values.

Bitcoin prices can linger in overbought or oversold zones. They might keep going that way for a while. Wait for the Balance of Power to cross zero.

In the example below, the BOP signal showed Bitcoin as oversold. Yet BTCUSD kept dropping until the indicator crossed above zero.

Analysis in BTCUSD Crypto Currency Trading

Study More Courses & Tutorials:

- The Ultimate Oscillator Indicator for BTC USD Trading on MetaTrader 4

- How to understand and look at a BTC/USD trading chart using technical indicators

- How Can You Analyze/Interpret BTC/USD Charts Using MT4 Bitcoin Trading Software Platform?

- Simple Start Guide for the MT5 Mobile Trading App

- Learning BTC/USD for New Traders

- What Will Happen to BTCUSD Prices After the Rising Wedge Happens?