Williams Percent R Analysis & Williams Percent R Signals

Williams %R Technical Indicator Developed by Larry Williams

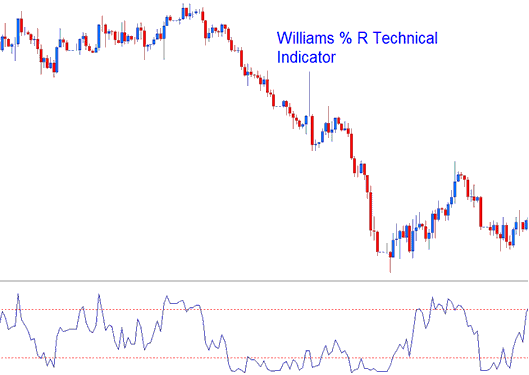

Williams %R indicator is pronounced as Williams percent R indicator. Williams %R Technical Indicator is a momentum oscillator used to analyze overbought and oversold levels in the markets.

The William % Range oscillator is similar to the Stochastic Oscillator indicator, apart from that fact that the % R is drawn upside down on a negative scale that's from 0 to -100 & the indicator doesn't apply a smoothing factor.

Williams %R, Percent R Technical Indicator - Indicators

The Williams %R indicator analyzes the association of the closing stocks prices relative to the High and Low range over a selected number of n candles.

- The closer the closing stocks price of a candlestick is to the highest high of the range selected the closer to zero the %R reading will be.

- The closer the closing stocks price of a candlestick is to the lowest low of the range selected the closer to -100 the %R reading will be.

When doing technical analysis a trader should ignore the minus sign placed before the value, for examples -40, the - sign should be ignored, just remember the indictor values are placed in an upside down manner.

- At zero: If the closing stocks price of the candlestick is equal to the highest high of the range the William %R reading will be 0.

- At -100: if the closing stocks price of the candlestick is equal to the lowest low of the range the William %R reading will be -100.

Williams Percent R Technical Indicator

Oversold/Overbought Levels on Indicator

- Overbought- William %R values from 0 to -20 are considered overbought while

- Oversold- Williams %R values from -80 to -100 are considered oversold.

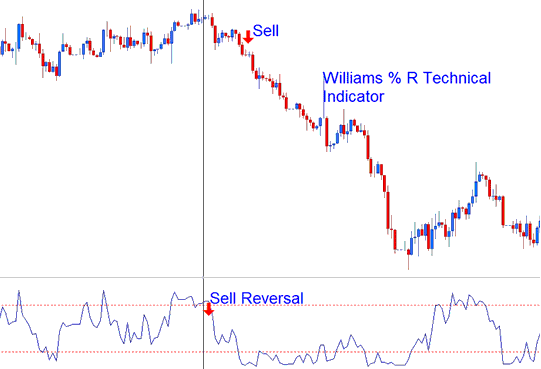

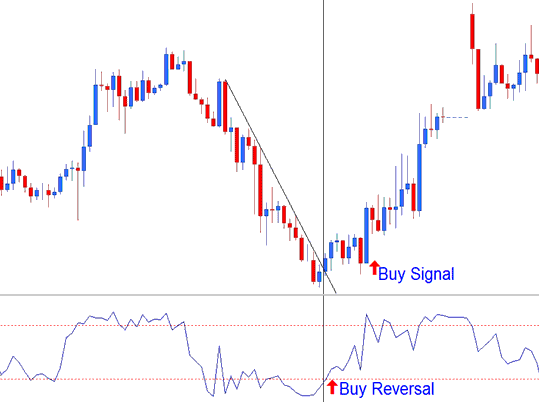

As for overbought/oversold levels it is best to wait for a instrument to change direction before taking a signal in the opposite direction. For Example if a instrument is oversold it is best to wait for the trend to reverse and start to head in an upward direction before buying the stocks.

Trend Reversal Signals

The William %R indicator used to predict a trend reversal signal when trading a stocks. Williams % R indicator always predict a reversal using the following technique

Bearish Reversal Signal- Williams Percent Range indicator forms a peak and turns down a few days before the price trend peaks and turns down. The example shown & described below displays %R giving a reversal signal before stocks price starts to head down and change to a down stock trend.

Bearish Reversal Signal after Stocks Trading Uptrend

Bullish Reversal Signal- Williams Percent Range indicator forms a trough and turns up a few days before the price trend bottoms and turns up.

Bullish Reversal Signal after Stocks Trading Downtrend