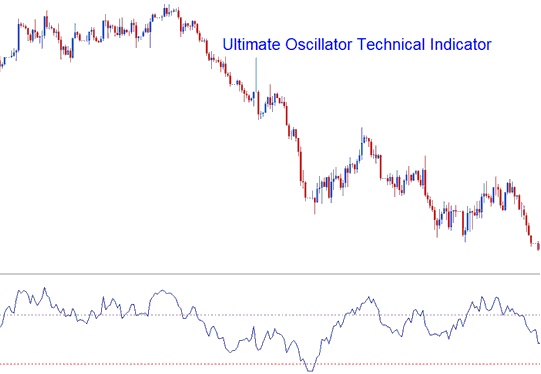

Ultimate Oscillator Analysis and Ultimate Oscillator Signals

Originally developed and used to trade and commodities markets.

This oscillator aims at striking a balance between leading signals & lagging signals given by the common indicators.

- Leading - some indicators lead the market and give signals earlier than the optimum time

- Lagging - some indicators lag the market so far that half of the move is over before a signal is generated.

This is the balance that the oscillator aims to strike, not to lead too much or lag too much - this way the oscillator will always give a signal at the ultimate time, thus its name.

This indicator uses 3 different n-number of candlesticks and calculates the combined weighted sums of price action from these candlesticks and plots these values a scale ranging from 0 to 100. Values of above 70 are considered to be overbought levels while values of below 30 are considered to be oversold levels.

The time periods used to calculate the ultimate oscillator are 7 periods (short term trend), 14 periods (intermediate term trend) & 28 periods (long term trend).

Stocks Analysis & Generating Signals

This indicator can be used in generating buy & sell signals using various methods.

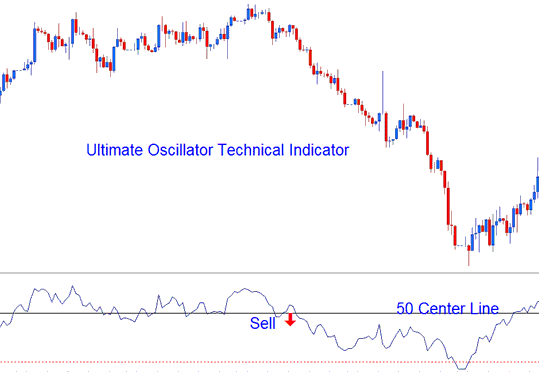

Center line Crossover Trade Signal

Buy Signal - values above 50 center line level

Sell Signal - values below 50 center line level

Center line Crossover Signal

Oversold/Overbought Levels on Indicator

Overbought - levels above 70 - sell signal

Oversold - levels below 30 - buy signal

Divergence Stock

The oscillator can also be used to trade divergence signals, below is an example of a classic bearish divergence signal.

Technical Analysis