Types of Traders: Scalpers, Day Traders, Swing Traders and Position Trading

Best Trader Type

There are different types of traders. The type of a trader one is depends on the amount of time which they hold their trade transactions.

The different types of traders also use different chart timeframes to place their trades.

The different types of traders are:

- Scalpers

- Day traders

- Swing traders

- Position traders

Each type of trader is explained below and as a beginner trader you can decide which type of trader you want to be based on your personality and the chart timeframe that you would want to be trading with.

Scalpers

The traders who are scalpers hold on to their trades for only a few minutes. With the objective of making a small amount of pips in profit, 5 to 10 to 20 pips.

Scalpers are the type of traders that make many stocks transactions in one day and participate in stock trading during the busiest market hours of the market. A scalper trader can open anywhere between 30 to 50 stock trades per day.

Scalpers are traders who can make quick decisions.

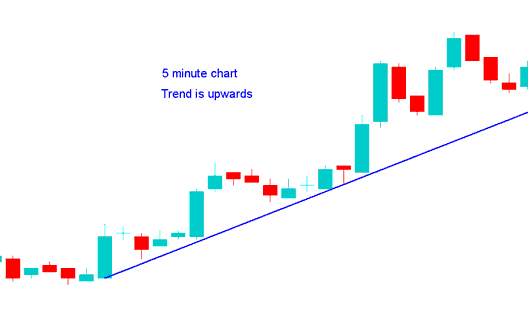

Scalpers use 1 minute charts to put their orders. They use 5 minutes Stocks chart timeframe to determine the trend, if the trend is going up or down and to decide their entry and exit.

Scalper 5 minutes stocks time frame stocks strategy

A Scalper using 1 minute chart timeframe wants to go long, checks 5 min chart, looks like the example illustrated and explained below, since it portrays the trend is moving up, the scalper will then decide it's okay to buy the stocks.

Types of Traders - Scalpers - Scalping Stock - Scalper Trader

Day Traders

Day Trader - This type of trader holds on to their trades for a few hours but not more than a day. With the objective of making quite a number of pips profit, 30 to 70 pips.

The day trader makes 2 or 5 stocks transactions in one day, participating during the busiest times of the market and they don't hold their orders overnight.

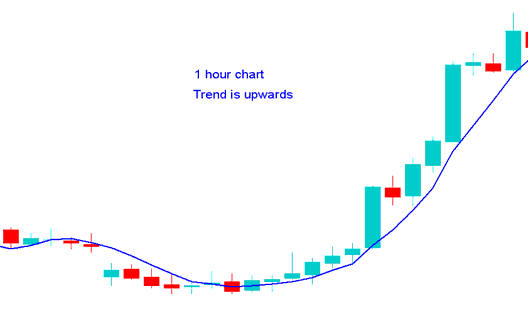

These traders use the 15 minutes Stocks charts to put their orders. They use 1 hour chart to determine the market trend, if it going up or down and to decide their entry & exit.

Day Trader 1 Hour time frame stocks strategy

A Stocks day trader using 15 min chart wants to go long, checks 1 hour chart timeframe, it looks like the example illustrated and explained below, since it portrays the market trend is moving up, the day trader will then decide it's okay to buy the stocks.

Types of Market Traders - Day Traders - Stock Day Trade - Types of Traders

Swing Traders

Stocks Swing Traders - This type of trader holds on to their trades for few days to a week - With the objective of making a large number of pips in profit, 100 to 400 pips.

This type of trading market trader makes an average of 2 to 5 stocks transactions in one week, holding onto their trades overnight. Swing stocks method requires traders who are patient.

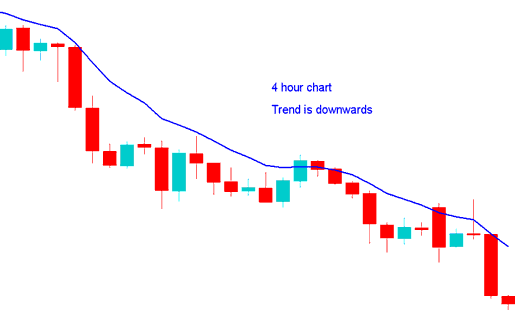

This type of trader uses the 1 hour Stocks charts to put their orders. Swing traders use the 4 hour chart to determine the trend, if it is going up or down and to decide their entry and exit.

Stocks Swing Trader 4 Hour chart timeframe stocks strategy

A swing trader using 1 hour candlesticks charts wants to go short, checks 4 hour candlesticks chart, it looks like the example illustrated and explained below, since it portrays the trend is moving down, the swing trader will then decide it's okay to Sell/Go Short the stocks.

Types of Traders - Swing Traders - Swing Stock - Swing Traders

Position Traders

Position Traders - This type of trader holds on to their stocks transaction for weeks or months. With the objective of making a big number of pips, 300 to 1000 pips.

Position Traders place an average of 2 to 5 orders in a year, position stocks method requires those who are patient, experienced and have huge account balances that can withstand huge draw-downs.

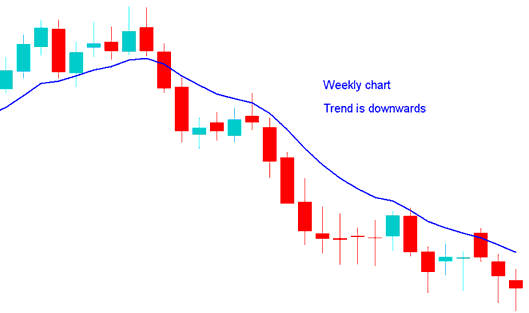

Position traders use 1 day or weekly charts to put their orders. They use weekly chart to determine the trend, if it going up or down and to decide their entry and exit.

Stocks Position Trader Weekly chart timeframe stocks strategy

Position trader using the daily candlesticks charts wants to go short, checks weekly chart timeframe, it looks like the example illustrated and explained below, since weekly chart timeframe shows the trend is moving down, the position trader will then decide it is okay to sell - Go short.

Types of Traders - Position Traders - Position Stock - Position Traders

What's the best trader type?

The most popular type of trader or the best trader type is the day trader & scalper trader depending on the method of stocks of each trader, but these two stocks methods are the most widely chosen stocks methods. Scalping stocks and requires those that can make quick decisions while day trading is for those who want their trades to run for longer and have more time when making stocks decisions. When starting it is best to try stocks scalping or day trading. This stocks methods are the best because you do not leave orders open for too long. At the same time you do not leave trades open overnight and you can trade when you have time to watch the market movements. In Stocks it is best keep orders open for as long as the trend setup is in your direction and exit immediately once the trend direction starts to reverse.

When it comes to the question about which type of stocks style is used by the best traders or by the top traders the two stocks methods above are the most commonly used stocks methods. traders can also automate these scalping or day trading styles by implementing their stocks strategies using automated stock bots.

For stocks swing traders, leaving trade transactions too long can also take up your profit and this stocks method also requires a lot of skills so it is best to stick to the short term stocks methods for most beginner traders.

Position stocks is not good as it requires a huge account balance and sometime it can result to huge draw-downs.

For stocks swing trading and position stocks methods, leaving a trade transaction open for too long, may mean these trades can reverse and move against you with a lot of pip movements and can even wipe your account, for this reason swing & position stocks methods are not very popular. It is best to stick to stocks scalping and day trading so as to better manage the funds in your stock account.

It is not recommended for the trader who is a beginner to leave orders open overnight, it's best to always close open orders at the end of the day.

Stocks News Traders - Types of Traders - News Trading - this stocks news trader places orders during economic news release time, either guessing the news will be positive/negative or placing pending orders above and below the price. News technique is risky as volatility is massive, whilst liquidity might be non-existent. You might not get filled or, worse, your stop loss might not be honored! News Trading technique can be very profitable for some traders but requires some skills.

Robot Traders - Types of Traders - Automated Traders - the trading robot trader - automated trader is the type of trader that uses automated programs known as stock robots - EA Automated Expert Advisors Robots to trade the online market. This automated trader will install an Automated Robot on their trading software & the automated bot will then open and close trades on behalf of the trader based on the trading strategy which has been used to program this automated stock bot. If you are new to automated stock trading and would like to find a trader using automated robots to help you come up with an automated bot, then you can find out more about automated trading on the Expert Advisors Article - MQL5 EA Robots Forum.