RSI Indicator Stock Patterns and Trend Lines

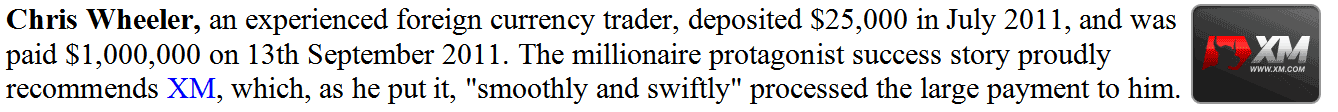

Traders can draw trendlines on the RSI in the same way as you can draw trendlines on the price charts. RSI trend lines are drawn the same way trend lines are drawn on the chart; by joining consecutive highs of the RSI indicator or consecutive lows on the RSI Indicator.

RSI Trend Lines and Trend lines on Charts

RSI Chart Patterns in Stocks

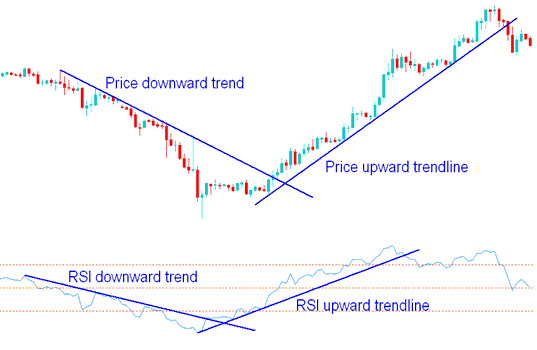

RSI Chart patterns such as head and shoulders chart patterns or triangle patterns that are not evident on the price chart are often formed on this RSI indicator.

RSI indicator also often forms chart patterns such as head & shoulders or triangles chart patterns that may or may not be visible on the price chart. As shown on the chart below the Reverse Head & Shoulders reversal formation is clearly shown on this stocks RSI indicator.

Stock Chart Setups on RSI Chart Indicator

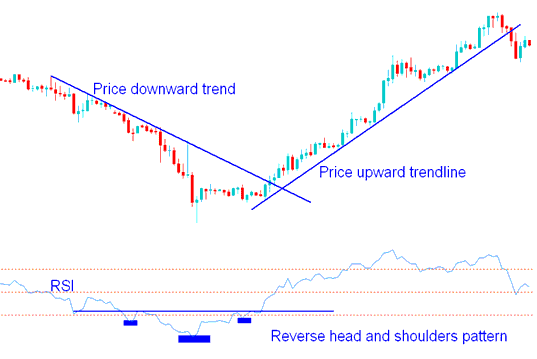

Support and Resistance Levels using RSI Indicator

Sometimes chart levels of support and resistance levels are demonstrated better on the RSI indicator than on the price chart.

In an upward market trend the support levels should not be broken at any one time, if they are broken then price will also break the support levels and the upward trend is going to reverse.

In a downward trend the resistance levels should not be broken, if they are broken then price will also break the resistance levels, and the downward trend is going to reverse.

Support and Resistance Areas on RSI Indicator

In the example above when the third resistance level was broken the downward trend reversed to an upward trend and when the sixth support was broken the upward market trend reversed and broke the upward trend line.