RVI Analysis & Relative Vigor Index Signals

Developed by John Ehlers

The Relative Vigor Index combines the older concepts of analysis with modern digital signal processing theories & filters to create a practical & useful indicator.

The basic principle behind it is simple –

- Stocks Prices tend to close higher than they open in up-trending markets &

- Stocks Prices close lower than they open in down-trending markets.

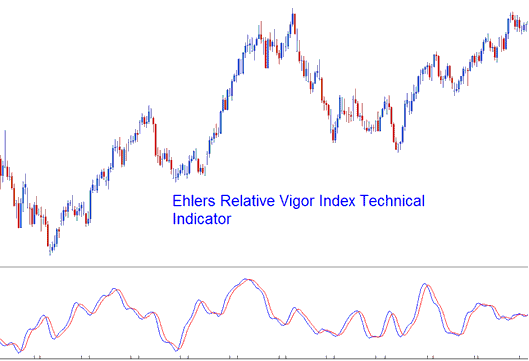

The momentum (vigor) of the move will therefore established by where the prices end up at the close of the candlestick. Relative Vigor Index plots 2 lines the RVI Line & the signal Line.

The RVI index is essentially based on measuring of the average difference between the closing & opening price, and this value is then averaged to the mean daily range & then drawn.

This makes the index a responsive oscillator that has quick turning points which are in phase with the market cycles of prices.

Technical Analysis & How to Generate Signals

The Relative Vigor Index is an oscillator. Basic strategy of analyzing the index is to use the cross-overs of the RVI & the Signal-Line. Signals are generated when there is a cross over of the two lines.

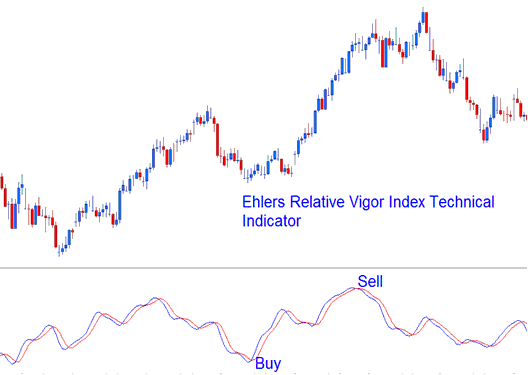

Bullish Signals - a buy signal occurs when the RVI crosses above the SignalLine.

Bearish Signals - a sell signal occurs when the RVI crosses below the SignalLine.

Buy & sell signals generated using the cross over method