MACD Hidden Bullish & Bearish Divergence

MACD Trading Hidden divergence pattern is used by traders as a possible sign for a trend continuation.

This MACD Trading Hidden divergence setup occurs when price retraces to retest a previous high or low. The two MACD Trading Hidden divergence setups are:

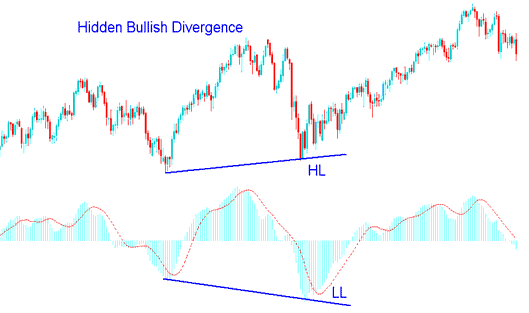

1. Hidden Bullish Divergence

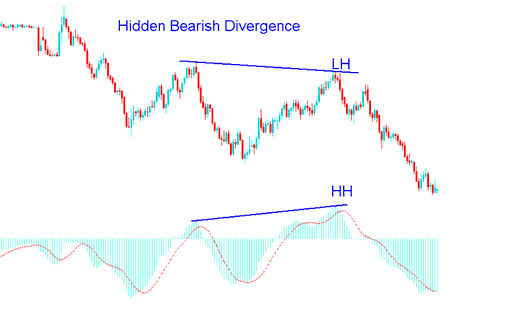

2. Hidden Bearish Divergence

Stocks Hidden Bullish Divergence in Stocks

MACD Hidden bullish divergence setup occurs when price is making a higher low (HL), but MACD oscillator is showing a lower low (LL).

Hidden bullish divergence forms when there's a retracement in an upwards stock trend.

MACD Bullish Divergence Strategy - MACD Bullish Divergence Trading Setup

This MACD bullish trade divergence setup confirms that a price retracement move is complete. This divergence indicates underlying strength of an up-ward stock trend.

Stocks Hidden Bearish Divergence in Stocks

MACD Hidden Bearish Divergence trade setup forms when price is making a lower high (LH), but the MACD oscillator is showing a higher high (HH).

Hidden bearish divergence set up forms when there's a retracement in a downwards trend.

MACD Bearish Divergence Strategy - MACD Bearish Divergence Trading Setup

This MACD hidden bearish divergence setup confirms that a price retracement move is exhausted. This diverging indicates underlying strength of a downwards stock trend.

NB: Hidden divergence is the best divergence set-up to trade because it gives a signal that is in the same direction with the trend. It provides for the best possible entry and is more accurate than the classic type of divergence signal.