Kaufman Efficiency Ratio Stocks Analysis & Kaufman Efficiency Ratio Signals

Developed by Perry Kaufman. Described in his book entitled "New Systems and Methods".

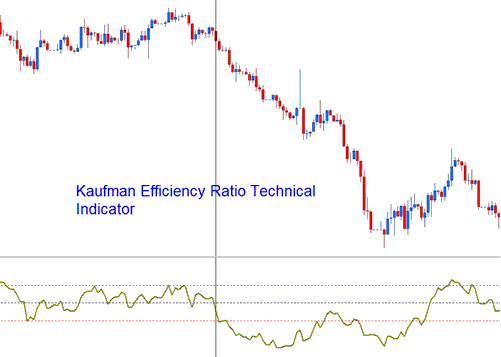

The Kaufman Efficiency measures the ratio of the relative market speed in relation to the volatility. Kaufman efficiency is often used by Stocks traders as a filter to help avoid trading when the market is "choppy" or flat ranging markets. The indicator also helps to identify smoother Stocks market trends. This is an indicator that oscillates between +100 & -100, where zero is the center point. +100 is upward trending market and -100 is downwards trending markets.

Kaufman Efficiency Ratio

The Efficiency indicator is calculated by dividing the net change in stocks price movement over an n number of periods by the sum of all the bar-to-bar stocks price changes taken as a absolute values over these same n periods.

Technical Analysis & Generating Stocks Signals

The Kaufman is used to generate stocks signals as follows:

The smoother the manner in which the market is trending then the greater the Efficiency Ratio shown by the indicator. Efficiency Ratio value readings of around zero indicate a lot of inefficiency or "choppiness" in the market stocks trend movements (ranging stocks markets).

- If the Efficiency Ratio shows a reading of +100 for a instrument, then that stocks instrument is trending upward with perfect efficiency.

- If the Efficiency Ratio shows a reading of -100 for a instrument, then that stocks price is trending downwards with perfect efficiency.

However, it is almost impossible for a market stocks trend to have a perfect efficiency ratio since any retracement movement against the current trend direction during the time period being used to calculate the indicator would decrease the efficiency ratio.

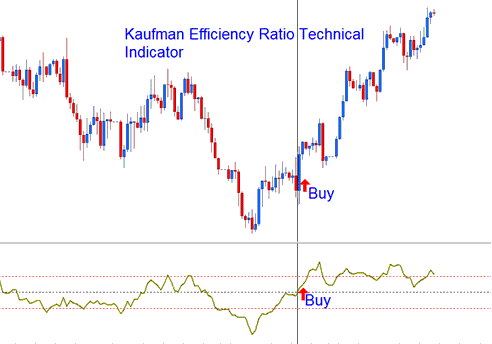

Bullish/Buy Stocks Signal

Efficiency Ratio values above +30 indicate a smoother upward trend.

Buy signal is generated above center-line mark.

Buy Signal

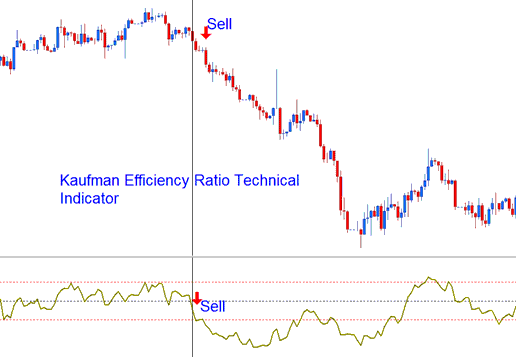

Bearish/Sell Signal

Efficiency Ratio values below -30 indicate a smoother downward trend.

Sell Signal is generated below zero center-line mark.

Sell Signal

However, it is good you experiment with other values to determine the most appropriate levels for the instrument being traded and the value that is the best for your stock technique that you are using.