Bollinger Bands Stocks Strategies Methods

- How Bollinger Bands Works

- Bollinger Bands Market Volatility Analysis

- Bollinger Bands Bulge and Squeeze

- Bollinger Bands Price Action in Trends

- Bollinger Bands Price Action in Range

- Bollinger Bands and Trend Reversals

- Bollinger Bands Stocks Strategy Summary

Bollinger Bands Indicator Strategy

Bollinger Bands indicator acts as a measure of volatility. Bollinger Bands indicator is a price overlay indicator.

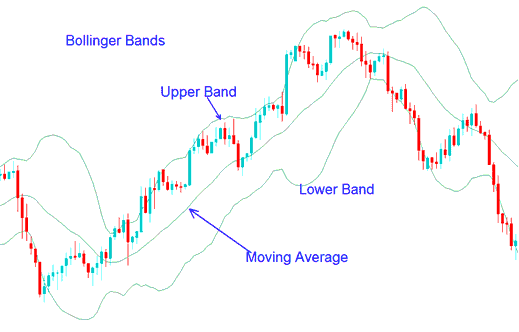

Bollinger Bands indicator consists of 3 lines or bands: the middle band (moving average), an upper band a lower band. These three bands will enclose the price & the price action will move within these three bollinger bands.

Bollinger Bands indicator forms upper & lower bands around a moving average. Default moving average for bollinger bands stocks indicator is the 20-SMA. Bollinger Band indicator use the concept of standard deviationss to form their upper and lower Bands.

The example of Bollinger Bands indicator is shown below.

Bollinger Band Stock Indicator - How to Trade Stocks with Bollinger Band Strategy

Because standard deviation is a measure of stocks price volatility and volatility of the market is dynamic, the bollinger bands keep adjusting their width. Higher stocks price volatility means higher standard deviation and the more the bollinger bands widen. Low stocks price volatility means the standard deviation is lower and the bollinger bands contract.

Bollinger Bands forex indicator use stocks price action to give a large amount of stocks price action movement information. The stocks price information given by the this bollinger bands stocks indicator includes:

- Periods of low volatility- consolidation phase of the market.

- Periods of high volatility - extended trends, trending markets.

- Support and resistance levels of the price.

- Buy and Sell points of the price.