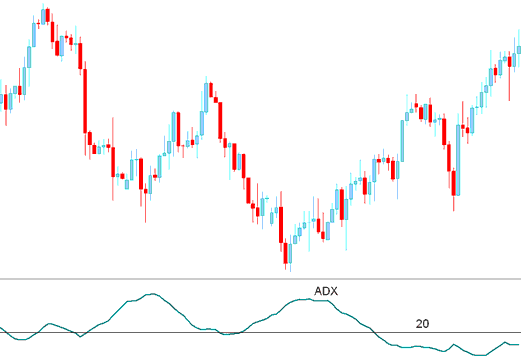

ADX Analysis & ADX Signals

Developed by J. Welles Wilder

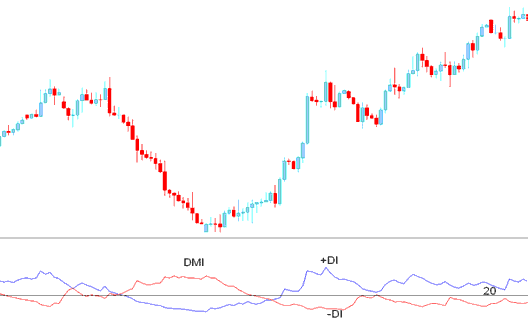

This a momentum indicator used to determine the strength of a price trend: it's derived from the DMI - Directional Movement Index which has two lines.

+DI - Positive Directional Movement Index

–DI - Negative Directional Movement Index

ADX is calculated by subtracting these two values & applying a smoothing function.

The ADX isn't a directional technical indicator but a measure of the strength of the stocks trend which has a scale of Zero to 100.

The higher the indicator value the stronger the trend.

A value of below 20 indicates that the stocks market isn't trending but heading in a range.

A value of above 20 confirms a buy or sell signal & indicates a new trend is emerging.

Values above 30 signifies a strong trending market.

When ADX indicator turns down from above 30, it indicates that the current trend is losing momentum.

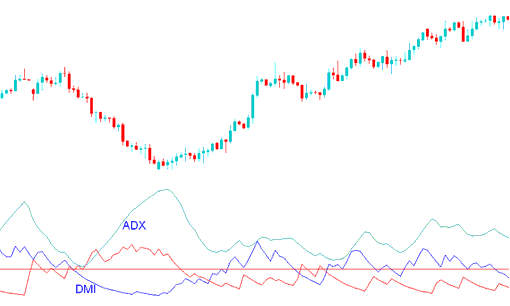

ADX combined with DMI Indicator

Since the ADX alone is a directionless indicator it is combined with the DMI index to determine the direction of the stocks.

DMI

ADX & DMI Index

When the ADX is combined with DMI index a trader can figure out the direction of the trend and then use the this indicator to determine the momentum of the prevailing stocks trend direction.

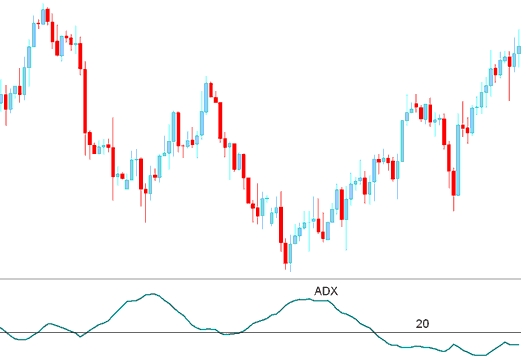

Technical Analysis & How to Generate Signals

Buy Signal

A buy signal is generated when the +DI is above –DI, and the ADX trade indicator is above 20

Exit trading signal is generated when the indicator turns down from above 30.

Buy Stocks Signal

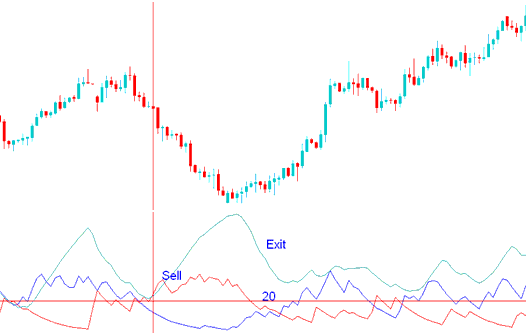

Sell Signal

A short signal is generated when –DI is above +DI, and the ADX trade indicator is above 20

Exit trading signal is generated when the indicator turns down from above 30.

Sell Stocks Signal