RSI Indicator Index Trading Strategy

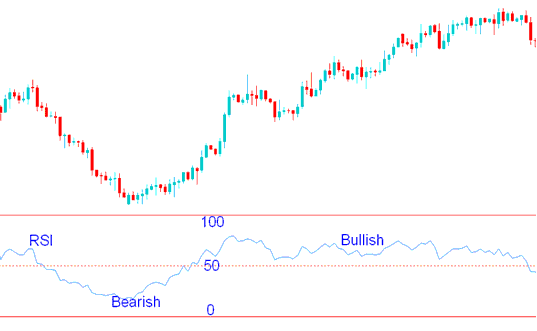

The Relative Strength Index, or RSI, ranks as a top tool for index trading. It acts as an oscillator that swings from 0 to 100. This tool tracks trend strength. Readings over 50 point to a bullish path. Those under 50 signal a bearish one.

RSI Indicator Measures Momentum of a Stock Trend.

The 50 line on the RSI shows the middle, and when it crosses, it means the trend is switching from going up to going down.

When RSI is over 50, buyers lead sellers. The price will rise as long as it stays above 50.

When below 50, sellers have more power than buyers, and the price on the trading chart will keep going down if the RSI stays below 50.

RSI Indicator - How to Trade with RSI Indicator

In the trading example illustration above, when the indicator is below 50, the price kept moving in a downwards market trend. The price continues to move down as long as RSI was below 50. When RSI moved above 50 it showed that the force had changed from sell to buy and that the downward trend had ended.

When RSI crossed above 50, price began to rise. The trend flipped from bearish to bullish. Price kept climbing, with RSI staying over 50.

Based on the trading example previously depicted, during periods of a bullish trend, any downward movement in the RSI that did not breach the 50 mark indicated that these were merely temporary pullbacks, as the overarching price trajectory remained decidedly positive. The existing trend is considered firm as long as the RSI remains above 50. This confirms why the 50 level is utilized as the critical divider signaling a transition between bullish and bearish Stock indicators.

The default RSI period is 14 days, as recommended by J. Welles Wilder, who introduced the indicator. However, traders frequently adjust this to periods like 9 or 25 days for their strategies.

The RSI period used depends on the trade chart time you're using: if you're using a daily trade chart, a 14 period means 14 days, while a one-hour chart means 14 hours. For our example, we'll use a 14-day average, but for your trading, you can change the day period to match the chart time you are trading with.

To Calculate RSI Indicator:

- Number of the days that a market is up is compared to number of the days that the market is down in a given time period.

- The numerator in the basic formula is an average of all the sessions that finished with an upwards price change.

- The denominator is an average of all the down sessions closes for that period.

- The average for the downward days is calculated as absolute numbers.

- The Initial RSI is then turned into an oscillator.

Sometimes very large up or down movement in price in a single session price period may & might skew the calculation of the RSI average & produce a false signal - in the form of a spike.

RSI Centerline Sits at 50. Above 50 means a bull trend. Gains beat losses on average. Below 50 points to a bear trend. Prices close lower than they open most times.

Points Where Things Are Too High or Low: Wilder said the RSI spots moments when the market is too high or low at 70 and 30.

Get More Topics and Tutorials: