Bullish and Bearish Index Signals

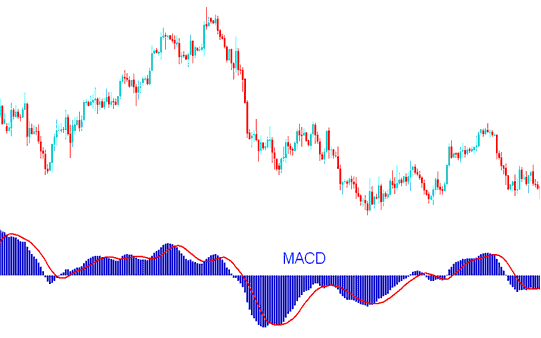

The MACD is a very common and popular tool that people use. It shows how fast prices are changing and follows trends a bit.

MACD is one of the most popular/liked indicators used in technical analysis. MACD is used to generate signals using crossovers.

MACD shows how moving averages come together and move apart. MACD is made using moving average studies. Moving Average Convergence/Divergence is a tool that follows trends. MACD shows how closely two moving averages are related.

One moving average is of a shorter period & the other for a longer period of the price bars.

MACD Indicator - MACD Indicator Analysis

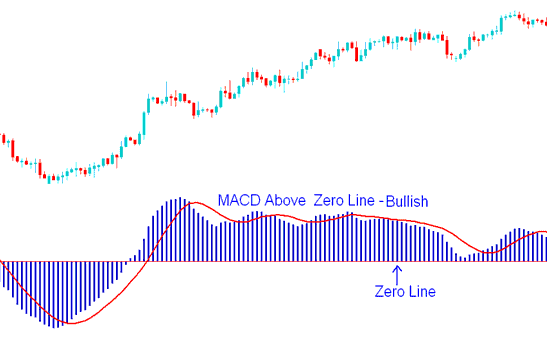

The MACD features a zero center-line: values above the zero line indicate a bullish trend, while those below signify a bearish trend.

In an uptrend, the short MACD line climbs faster than the long one, forming a gap. As long as MACD stays above the center, the trend remains bullish.

Avoid selling while the MACD indicator remains above the center line mark. This signifies a bullish region, regardless of its movements, as long as it persists above the zero center line, as illustrated below.

MACD Indicator Above Zero Mark - Bullish Index Signal

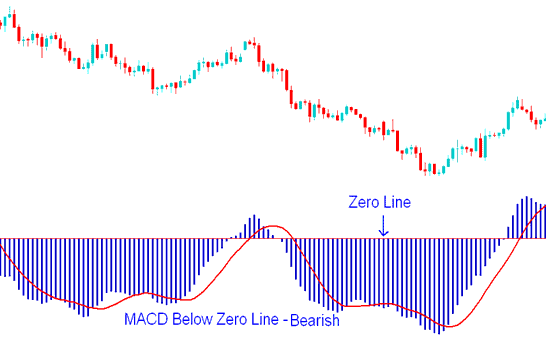

In a downwards trend the shorter MACD line falls faster than the longer MACD line this creates a gap. In addition as long as the technical indicator is below the center line the trend is still bearish as is illustrated below.

Avoid purchasing as long as the MACD indicator is positioned below the zero Center Line Mark. This region signals bearish activity, regardless of movement direction while remaining below this threshold, as shown in the example below.

MACD Indicator Below Zero Center Line Mark - Bearish Index Signal

When trend is about to turn and reverse the MACD lines begin & start to move closer to each other, thus closing the gap.

Study More Guides and Topics: