TIPS: MAXIMIZING PROFITS OF Stock Indices SYSTEMS

1. Define Simple Stock Indices Rules and Follow the Trend

The simpler the system is the better. If the system is too complicated, it will be very difficult to stick to the rules. Complicated stock systems are also very confusing. A simple stock system makes it easy to follow the trading rules.

2. Eliminate Risk Quickly and Let Profits Run

Minimizing risk is far more important than making money. Our first objective in stock indices is to make the trade less risky. We do this by entering only trade setups, setting stop losses, cutting losses quick and never average down, and letting the profitable trades run for a while, just long enough but not too long so as increase the profits. Profitable trades are only kept open as long as the system shows the trend is in place, these transactions should be closed immediately once your exit signal criteria is generated by the stock index trading system.

3. Choose the Right Stock Indices instruments

Once you have your stock system, you will want to start testing it on a demo trading account. A stock system will give different results for each stock indices.

To maximize the profitability of your stock system find the most active market hours for a chosen stock index and trade during that market session only.

4. Use Stock Index Money Management Rules

Always risk less than 2% per stock trade transaction. With compounding, you will be surprised to see how quickly your stock index trading account grows once you begin to trade with a profitable stock system.

5. Keep a Stock Journal

Keeping a log of all your stock index trades will help you to become a better and better and will help you follow the trading rules of your stock system. A stock indices journal will also keep track of your profitable trades & losses & you can analyze why a trade setup was profitable & why it was not.

6. Set take Profit Targets

Establish a daily, weekly or monthly profit targets when trading the trading market. Once you hit this target. This will stop you from over-trading and will also stop you giving back your profits the trading market. Keep your reward to risk ratio high, a 3:1 reward to risk ratio is best. This means opening stock indices trade transactions only when you have the probability of making three times what you're risking.

Examples of signals generated by our trading system

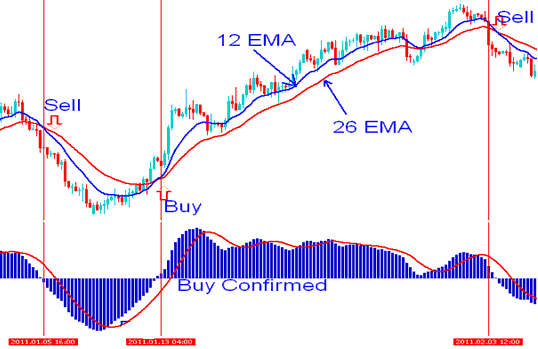

Example 1: Buy Stock Signal & Sell Stock Signal Generated By Stock System

Buy signal is generated by the indicator based stock system, then an exit signal is generated before another reverse sell signal is generated on this stock index chart

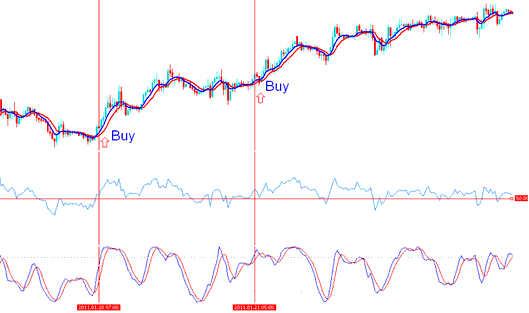

Example 2: Two buy signals generated by Stock System

Two buy signals are generated during the upwards trending market

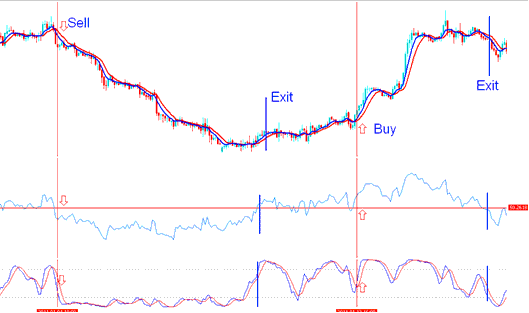

Examples 3: Exit Signal Generated by Stock System

Examples of Stock Trade Signals Generated by a Stock System

Other Tips

Learn Education

First tip is to learn about the Market (Learn Lessons), those who don't learn the required stock indices knowledge from the various tutorials online will not improve their results no matter how many tips they have read. By not learning stock indices, these traders will keep making the obvious mistakes made by stock indices novice traders without even realizing what they are doing, Stock Indices is a wide topic and in order to make profits a trader will have to learn stock indices first.

Get a Stock System

A system is a must for every trader, a stock system is used to determine what stock indices decision to take. A stock system gives a trader an edge over others who don't have a plan. A good stock indices plan is one that is back-tested and proven to produce profitable stock trades. After coming up with your stock system you should back-test it on a Demo Account.

Learn Stock Money Management

Learn about The Various Stock Index Money Management Lessons, don't attempt to trade the online market if you do not have stock money management guide-lines. The 2 stock indices management lesson that you must learn are:

What is Stock Money Management

Stock Money Management Strategies Methods

Learn about Leverage & Margin

If you don't know what is leverage & how it works and how it can affect your stock margin, then you will not make any money in the market and you will lose your money in the stock index trading market.

Have a Written Plan

A stock indices plan will take into account all the above stock tips and summarize them within one document that you can use to trade the online stock index market.

In General

The first goal should be taking your time to really ascertain what your goals are and how much money you wish to make. Once this is determined then the following three suggestions will help you on your way to start Stock Indices. It is essential to keep all the three goals in mind when executing all of your trade transactions but at the same time this is not a black and white guide to stock indices success.

The first thing is to remember that you really need to work with short term trades until you become profitable and know how to properly monitor these trade transactions. You should trade short term because this way you can monitor your positions and quickly close any position whose trading signal setup reverses. In order to truly benefit from the system you have to be willing to take up the effort to watch the market to see exactly how long you can keep your money invested in the online market. Making short-term stock indices investments will help you to monitor your stock index trades and control all the risks, do not leave orders open when you are away from your computer or when you are going to sleep, close all stock indices trade transactions and only open orders when you can monitor them.

Although it is very important to increase the amount of stock index trades that you are investing each time that you trade - some stock indices guidelines should to be followed. The general rule of stock indices tends to be never to trade more than two percent of your total account equity. This of course makes sense when you have a lot of money in your account but what if you only have a couple of hundreds. Two percent of $10,000 equals out to be $200. Even though it is safer to follow this rule it really does not make a lot of economic sense with smaller accounts. If you are investing on Stock Indices this is when leverage kicks in to effect and makes all of the difference. In General the more stock indices capital you have to invest the better in terms of stock money management.

The final suggestion is taking a bit of time to make sure that you get all of your details correct before opening any one trade transaction, this will be the best method. Keep it simple makes just as much sense in stock index market than anywhere else. Although this might require more time & effort to build up your stock profits it will save you money in the long term.

Trying to keep your thinking as clear as possible will make your stock indices journey easier but knowing when to break from the norm is also important. Moving towards the right path will make success that much more easier to obtain and by learning all of the steps and logic you will be able to continue making profits. Stock Indices is not hard to learn but a lot of traders lose money quickly because of not taking the proper steps in preparation & learning.