Stochastic Oscillator Stock Indices Technical Analysis and Stochastic Oscillator Stock Indices Signals

Developed by George C. Lane

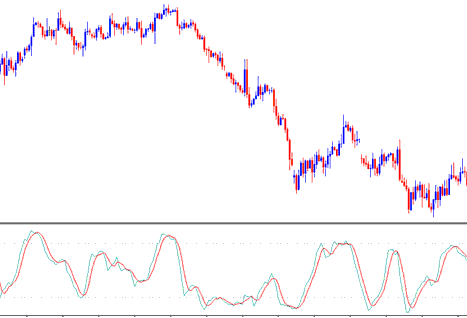

The Stochastic Oscillator is a momentum indicator - it shows the relation between the current closing price relative to the high & low range over a given number of n periods. The Oscillator uses a scale of 0-100 to draw its values.

This Oscillator is based on the theory that in an up stock trend market the price closes near the high of the price range & in a downward trending market the price will close near the low of the price range.

The Stochastic Lines are drawn as 2 lines- %K & %D.

- Fast line %K is the main

- Slow line %D is the signal

3 Types of Stochastics Stock Indices Oscillators: Fast, Slow & Full Stochastics

There are Three types are: fast, slow and full Stochastic. Three indicators look at a given chart period for examples the 14-day period, and measures how the price of today’s close compares to the high/low range of the time period that's being used to calculate the stochastic.

This oscillator works on the principle that:

- In an upwards stock trend, price tends to close at the high of the candlestick.

- In a downwards stock trend, price tends to close at the low of the candlestick.

This technical indicator shows the momentum of the trends, and identifies the times when a market is overbought or oversold.

Technical Analysis & How to Generate Signals

Most common techniques used for analysis of Stochastic Oscillators to generate signals are cross overs signals, divergence signals & overbought oversold levels. Following are the techniques used for generating signals

Indices Crossover Signals

Buy signal - %K line crosses above %D line (both lines heading up)

Sell signal - %K line crosses below %D line (both lines heading down)

50-level Crossover:

Buy signal - when stochastic lines cross above 50 a buy stock trade signal is generated.

Sell signal - when stochastic lines cross below 50 a sell stock trade signal is generated.

Divergence Indices

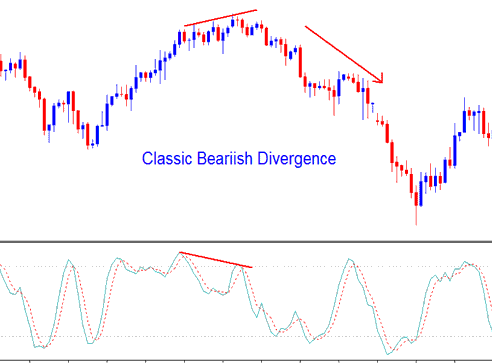

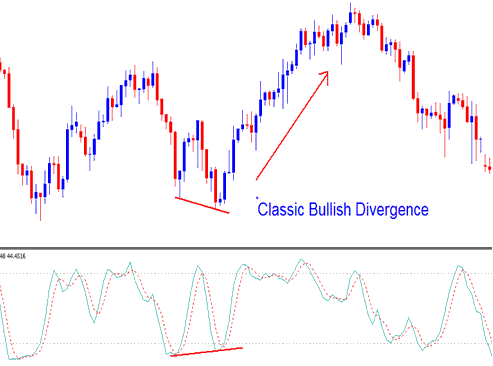

Stochastic is also used to look for divergences between this indicator & the price.

This is used to determine potential stock trend reversal signals.

Upward/rising stock trend reversal - identified by a classic bearish divergence

Trend reversal - identified by a classic bearish divergence

Downwards/descending stock trend reversal - identified by a classic bullish divergence

Trend reversal - identified by a classic bullish divergence

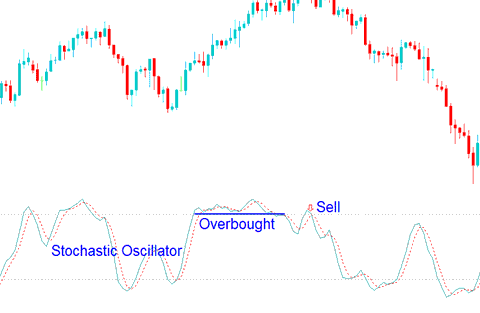

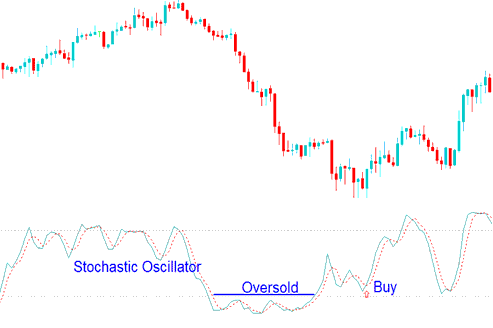

Overbought/Oversold Levels on Indicator

Stochastic is mainly used to identify potential overbought & oversold conditions in price movements.

- Overbought values greater than 70 level - A sell signal occurs when the oscillator rises above 70% & then falls below this level.

Overbought - Values Greater 70

- Oversold values less than 30 level - a buy signal is generated when the oscillator goes below 30% and then rises above this level.

Oversold - Values Less Than 30

Trades are generated when the Stochastic Oscillator crosses these levels. However, overbought/oversold levels are prone to whipsaws especially when the market is trending upwards or downward.